How To Compute SSS Pension: A Definitive Guide

Retirement can mean a lot of things for different people.

It’s not just the perks that come with being called a senior. It also could be the smell of freshly brewed coffee at 6 a.m. as you sit on the veranda while watching the sunrise. Or it could be the time spent playing with your grandkids because all your children are home for Christmas.

These are very ideal scenarios to think about retiring, and hopefully, peace of mind comes with it, too. However, this is not always the case with rising inflation and healthcare expenses that come with old age.

According to the Bangko Sentral ng Pilipinas (BSP), 80% of Filipinos1 are financially ill-prepared for retirement with the majority of the elderly citizens not covered by social security or retirement plan2.

Although government benefits will not cover your entire living expenses as you grow old, it is still important to take advantage of these services to ease your financial burden in the future.

One of the programs offered by the government to protect you financially is through the Social Security System or SSS. The SSS grants retirement benefits to covered members who can no longer work due to old age, given that they have paid at least 120 monthly contributions.

In this guide, you’ll learn how to compute or estimate how much monthly pension you can get from SSS so you can properly plan for your retirement.

Table of Contents

- At a Glance: How to Compute SSS Retirement Benefits in the Philippines

- Formula 1: The minimum pension shall be PHP 1,200 for members with at least 10 CYS and P2,400 for those with at least 20 CYS

- Formula 2: 40 percent (40%) of the average monthly salary credit

- Formula 3: The sum of PHP 300 plus 20 percent (20%) of the average monthly salary credit plus two percent (2%) of the average monthly salary credit for each Credited Years of Service (CYS) in excess of 10 years.

- How To Compute SSS Pension Through the SSS Retirement Estimator Tool

- What Is an SSS Pension?

- What Is the SSS Retirement Age?

- Tips and Warnings

- Frequently Asked Questions

- 1. Can I get my SSS retirement benefits early?

- 2. What happens to the retirement benefits if the SSS retiree-pensioner dies?

- 3. How much is the maximum SSS pension?

- 4. How many contributions should I have to receive an SSS pension?

- 5. How to compute the AMSC (Average Monthly Salary Credit) in SSS?

- 6. How to compute the monthly contribution?

- 7. How to compute the SSS pension for OFWs and voluntary members?

- 8. Which is a better strategy: Paying the maximum monthly contribution as early as possible or paying only the minimum and increasing it to the maximum during the last few years before retirement?

- 9. How can I increase my SSS pension?

- 10. The member is 59 years old or way past the retirement age (older than 65) but hasn’t completed the 120 contributions yet. Can he/she still continue paying contributions?

- 11. Is the SSS pension enough?

- References

At a Glance: How to Compute SSS Retirement Benefits in the Philippines

There are three ways to compute the retirement benefit3. All formulas are considered and the HIGHEST RESULT among the three will be the final monthly pension.

To understand better, we will demonstrate each formula by using PHP 20,000 as the Average Monthly Salary Credit (AMSC) and 25 years as the Credited Years of Service (CYS).

The Credited Years of Service (CYS) are simply the number of years you contributed to the SSS fund. To learn what the Average Monthly Salary Credit (AMSC) means, please see the FAQ section below.

Formula 1: The minimum pension shall be PHP 1,200 for members with at least 10 CYS and P2,400 for those with at least 20 CYS

Using this formula, the monthly pension will be PHP 2,400 since the CYS is 25. This is the guaranteed pension for members paying the minimum monthly contribution.

Formula 2: 40 percent (40%) of the average monthly salary credit

= 40% x 20,000 AMSC

= 8,000

Based on this formula, the pension will be PHP 8,000.

Formula 3: The sum of PHP 300 plus 20 percent (20%) of the average monthly salary credit plus two percent (2%) of the average monthly salary credit for each Credited Years of Service (CYS) in excess of 10 years.

= 300 + 20%AMSC + [(2% of ASMC) x (CYS – 10)]

= 300 + (20% x 20,000) + [(2% x 20,000) x (25-10)]

= 300 + 4,000 + [400 x 15]

= 10,300

Comparing the 3 formulas, the one that obtained the highest amount is Formula 3, therefore the member will be granted a PHP 10,300 basic pension.

Pursuant to a Memorandum from the Executive Secretary (dated February 22, 2017)4, there is also an additional benefit of PHP 1,000 monthly pension so in our illustration, the regular pension will now be PHP 11,300.

Aside from this, the retiree pensioner will also receive a 13th-month pension (payable every December)5, which in our current example is equivalent to PHP 11,300.

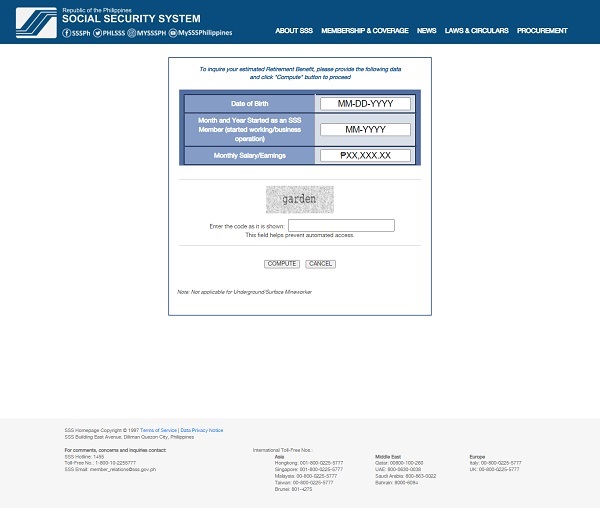

How To Compute SSS Pension Through the SSS Retirement Estimator Tool

An easier way to compute the estimated retirement benefit is through the estimator tool available on the SSS website. The tool calculates your pension by capturing your date of birth, the date you started as an SSS member, and your monthly salary. It will then provide you with the estimated SSS pensions, first at 60 years old and the other one at 65.

For an in-depth look at your projected retirement benefit, you can log in to the My.SSS portal and go to the Simulated Retirement Calculator under E-Services.

What Is an SSS Pension?

The SSS pension is the monthly cash benefit given to SSS member-retirees who have paid at least 120 monthly contributions prior to the semester of retirement.

There are actually two types of retirement benefits provided by the SSS. One is the lump sum amount or one-time payment which is granted to a retiree who has not reached the required 120 monthly contributions. It is equal to the total amount paid by the member and by the employer, including the interest earned. The other type is the monthly SSS pension or a lifetime cash benefit granted to a retiree who has paid at least 120 monthly contributions to the SSS prior to the semester of retirement.

Qualified members have the option to receive their pension on a monthly basis, or to claim the first 18 months retirement benefit in advance, and then start receiving monthly pensions on the 19th month. The total amount is based on the member’s paid contributions, credited years of service or the number of years that the member contributed to the SSS fund, and the number of dependent minor children not exceeding five dependents.

What Is the SSS Retirement Age?

There are two kinds of SSS retirement age – the optional and the mandatory6. The optional age of retirement is age 60, given that the member is no longer employed and has paid at least 120 monthly contributions. The mandatory or technical age of retirement, on the other hand, is for retiring members at 65 years and above.

There is, however, an exemption for underground mine workers as they have a lower retirement age. Miners are allowed to retire at 55 years old (optional retirement) or 60 years and above (mandatory retirement). The underlying conditions are (1) they should be a mine worker for 5 years and (2) they should be working at a mining company accredited by the Bureau of Mines and Geosciences.

The 120 months can be consecutive or accumulated, meaning the member can still qualify for the pension even he/she didn’t pay for the monthly contributions consistently, provided that the overall number of contributions is at least 120.

Tips and Warnings

1. Keep your records accurate

Before you retire, make sure that your records are correct, such as your birthday, your name, and your SSS number. This is to avoid hassles and delays in processing your retirement benefit.

2. Secure only one SSS number to use in all of your transactions

Having multiple numbers can also cause delays in processing your pension or loan applications. In the event that you have more than one SSS number, go to the nearest SSS branch to cancel your other number/s and consolidate all your contributions into a single retained SSS number.

3. Report any changes in your personal record

If there’s a change in your marital status or list of your beneficiaries, report it to the nearest SSS branch and submit a Member’s Data Change Request (SSS Form E-4) and the required supporting documents:

- Change of civil status from Single to Married – Marriage contract

- Change of civil status from Married to Single – Death certificate (if due to death of previously reported spouse); Certificate of Finality of Annulment or Decree of Divorce

- New/additional/change of dependents/beneficiaries – Birth or Baptismal Certificate(s) of children or marriage contract for spouses

- Correction of name/date of birth – Birth or Baptismal Certificate or unexpired Passport

Related Article: How to Change, Correct, or Update Your SSS Membership Data

4. Monitor your contributions

As an employee, you still get the benefits of being a member regardless if your employer fails to remit your SSS contributions. However, your employer may be subject to penalties, or worse imprisoned. You may check your records through the My.SSS portal website or mobile application.

5. Pay your loans to avoid penalties

Unpaid loans will be deducted from your retirement benefits. Therefore, make sure you settle all your financial obligations with SSS before you file for retirement. This is to ensure you’ll get the maximum amount of monthly pension commensurate to your total number of contributions.

Related Article: How to Pay SSS Salary Loan: An Ultimate Guide

6. Once you have registered as an SSS member, you are already a member for life

Your membership cannot be withdrawn and your contributions cannot be refunded.

Frequently Asked Questions

1. Can I get my SSS retirement benefits early?

The earliest retirement age by which SSS members can choose to retire is 60 years old. However, members who suffered permanent disability, either partial or total, are eligible for the SSS Disability Benefit.

2. What happens to the retirement benefits if the SSS retiree-pensioner dies?

If in case the retiree-pensioner dies, the primary beneficiaries are entitled to 100% of the retirement benefit and the dependent minor children will continue to receive the dependent’s allowance.

3. How much is the maximum SSS pension?

In 2019, the highest amount of pension being paid by SSS for a retiree-pensioner was PHP 18,9457 while the minimum amount of pension was PHP 2,000. These already included the PHP 1,000 additional benefit.

Aside from the ASMC and CYS, another factor that can affect the amount of your SSS pension is if you have dependents as this can increase your pension by 10% or PHP 250 on top of your basic pension, whichever is higher.

4. How many contributions should I have to receive an SSS pension?

You need to have at least 120 paid monthly contributions before retirement to be eligible for a monthly pension. If your total SSS contributions did not reach the minimum 120 contributions, you will instead receive a lump sum amount. This is applicable for members who paid for a total of 36 to 119 monthly contributions. However, if the number of your contributions is less than 36, you will not be qualified for SSS pension benefits.

5. How to compute the AMSC (Average Monthly Salary Credit) in SSS?

Your monthly salary credit or MSC is the compensation base set by SSS for contributions and benefits. As your salary increases, so does your MSC. Members with high MSC pay higher contributions and in turn, will receive higher benefits.

There are two ways you can compute your Average Monthly Salary Credit. The final AMSC amount should be the greater of these two:

- Sum of the last 60 monthly salary credits prior to the semester of retirement divided by 60; or

- Total salary credits prior to the semester of retirement divided by the total number of contribution

6. How to compute the monthly contribution?

The monthly contribution varies for employees, OFWs, self-employed, voluntary paying members, and employers. If you are an employee, you are paying only 4.5% of the required 13% monthly contribution while the remaining 8.5% is shouldered by your employer.

If you are self-employed, a voluntary member, or an OFW, you must pay the full 13%.

Related: How to Compute Your SSS Contribution: An Ultimate Guide

7. How to compute the SSS pension for OFWs and voluntary members?

The three formulas to compute the monthly SSS pension apply to all SSS members including OFWs, self-employed, and voluntary paying members.

8. Which is a better strategy: Paying the maximum monthly contribution as early as possible or paying only the minimum and increasing it to the maximum during the last few years before retirement?

If your goal is to enjoy other SSS benefits and get the maximum amount when applying for a loan, then paying the maximum monthly contribution as early as possible is a more favorable option. However, if your goal is solely to receive the maximum retirement pension, a better and more practical way is to pay only the minimum and then start maximizing your contributions five years before your retirement. This strategy is based on the computation of AMSC which takes into account the last 60 monthly salary credits prior to the semester of retirement.

Why is it more practical? If for instance, you’re at the PHP 10,000 compensation bracket, your required minimum contribution is at PHP 450. Meanwhile, the maximum contribution currently allowed by SSS is PHP 2,600. You started working at 23 years old and wanted to retire early. Believing that you will receive a higher pension in the future, you decided to pay the maximum contributions of PHP 2,600 monthly for 37 years. The total amount you have contributed before retirement is PHP 1,154,400.

But surprisingly, you will only be getting roughly around PHP 7,700 monthly pension at 60 years old – the same amount of pension you will be receiving if you decided to pay PHP 450 in the first 32 years, and then PHP 2,600 in the last five years before the semester of your retirement. In the second option, you only contributed a total of PHP 328,800 to SSS.

By choosing the second strategy, you will be saving around PHP 825,600. Imagine if you put this money in a high-interest savings account, or invested it in Pag-IBIG MP2. You will have more funds in the future due to compounding interest, maybe even higher than the maximum pension you will get from SSS.

9. How can I increase my SSS pension?

You can increase your SSS pension by following these strategies:

- Pay the maximum amount of monthly contribution as early as possible.

- Never miss a payment and always pay your contributions before the due date. SSS doesn’t allow retroactive payments or payment of contributions for the months you’ve missed.

- Continue paying your contributions even after you have reached the required 120 contributions. Being an active member allows you to have access to sickness, maternity, and disability benefits on top of your retirement benefit. The longer you’ve been paying your contributions, the more benefits and pension you’ll enjoy.

- Pay all your unpaid loans before applying for retirement benefits. Any unpaid loan will be deducted from your SSS pension if you don’t settle it prior to your retirement.

10. The member is 59 years old or way past the retirement age (older than 65) but hasn’t completed the 120 contributions yet. Can he/she still continue paying contributions?

Yes. Retiring members who have paid less than 120 contributions can opt to continue paying contributions as voluntary members until they complete the minimum number required. This way, they will still be able to enjoy the benefits of having a monthly pension. Take note, however, that members 55 years old and above are only allowed to increase their contributions once a year and by a maximum of one bracket from their previous compensation bracket.

11. Is the SSS pension enough?

Without a doubt, the SSS pension will be of great help in your old age to cover some of your living expenses, but it will not be enough to fund your retirement.

In 2018, the national average expenditure was PHP 238,641 per year8. Using the previous example (see FAQ #8), receiving a monthly pension of PHP 7,700 is not sufficient to cover even half of your monthly expenses, more so if you consider inflation in the next coming years.

It is important to save as early as now and plan for your future as soon as possible to take advantage of the investment options available for you. When nearing the retirement age, it is traditionally advised to be more conservative with your investments because your goal is no longer to grow your assets but to protect them.

There are a lot of good resources online on financial literacy. If you have no means to invest yet, be sure to read as much as you can. Time is money. Use it efficiently to gain more knowledge on how to manage your finances or to add multiple streams of income.

Related: How to Build Emergency Fund in the Philippines: An Ultimate Guide

References

- Lucas, D. (2020). 80% of retiring Pinoys not financially prepared. Retrieved 14 September 2021, from https://business.inquirer.net/310472/80-of-retiring-pinoys-not-financially-prepared

- Mina, C. (2019). Are Filipino senior citizens financially protected?: Evidence from Consumer Finance Survey. Presentation, Crown Plaza Manila Galleria, Quezon City, Philippines.

- Social Security System (SSS). Types of Retirement Benefit [PDF]. Retrieved from https://www.sss.gov.ph/sss/DownloadContent?fileName=Retirement_Qualifying_Types.pdf&fbclid=IwAR3Ixs_h9K4YuSrubM4M7afLvE6NFUrTfLO3op2S2605X4gH9qMo4JwXNmw

- SSS Corporate Communications Department. (2019). Social Security Act of 2018 (Republic Act No. 11199) [Ebook] (p. 18). Retrieved from https://www.sss.gov.ph/sss/DownloadContent?fileName=Booklet_SS-ACT-OF-2018_05172019.pdf

- Social Security System (SSS). (2018). What you need to know about the SSS Retirement Benefit [Video]. Retrieved from https://www.youtube.com/watch?v=qhRnS9O11Us

- Retirement Benefit. Retrieved 14 September 2021, from https://www.sss.gov.ph/sss/appmanager/viewArticle.jsp?page=retirement

- SSS: 2.5M pensioners receive P62B pension from Jan to May 2019. (2019). Retrieved 14 September 2021, from https://www.sss.gov.ph/sss/appmanager/viewArticle.jsp?page=NR2019_034

- Final 2018 Family Income and Expenditure Survey (FIES) Press Release and 2018 FIES Final Report. (2020). Retrieved 26 September 2021, from https://psa.gov.ph/content/final-2018-family-income-and-expenditure-survey-fies-press-release-and-2018-fies-final

Written by Miriam Burlaos

Miriam Burlaos

Miriam is addicted to learning new things and constantly looks for brand new knowledge to be obsessed about. She currently works full-time as an underwriting assistant while pursuing her passion for writing on the side. Nowadays, she’s also learning how to code because she wants to see her ideas come to life.

Copyright Notice

All materials contained on this site are protected by the Republic of the Philippines copyright law and may not be reproduced, distributed, transmitted, displayed, published, or broadcast without the prior written permission of filipiknow.net or in the case of third party materials, the owner of that content. You may not alter or remove any trademark, copyright, or other notice from copies of the content. Be warned that we have already reported and helped terminate several websites and YouTube channels for blatantly stealing our content. If you wish to use filipiknow.net content for commercial purposes, such as for content syndication, etc., please contact us at legal(at)filipiknow(dot)net