𝗡𝗢𝗧𝗜𝗖𝗘 𝗢𝗙 𝗠𝗜𝗟𝗟𝗔𝗚𝗘 𝗥𝗔𝗧𝗘 𝗛𝗘𝗔𝗥𝗜𝗡𝗚𝗦

The City of Statesboro has tentatively adopted a millage rate that will require an increase in property taxes by 6.39 percent over the rollback millage rate. All citizens are invited to the public hearing on this tax increase to be held in the City Hall Council Chambers located at 50 East Main Street on August 30th at 9:00 am and 6:00 pm. 𝗮𝗻𝗱 September 6th at 9:00 am.

𝗠𝗢𝗥𝗘 𝗔𝗕𝗢𝗨𝗧 𝗧𝗛𝗘 𝗠𝗜𝗟𝗟𝗔𝗚𝗘 𝗥𝗔𝗧𝗘 𝗛𝗘𝗔𝗥𝗜𝗡𝗚𝗦:

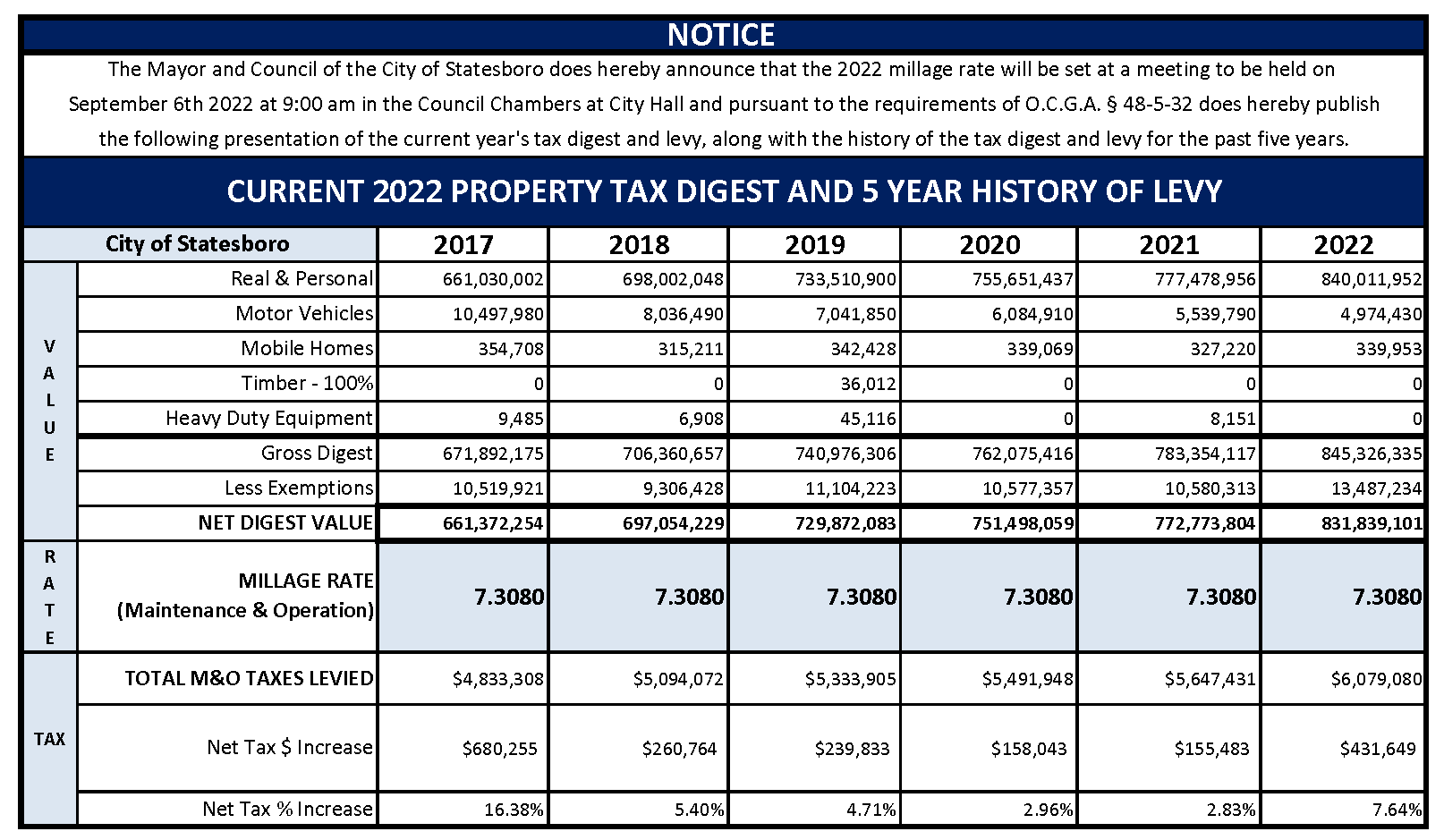

According to Georgia Law, all taxing agencies must advertise a tax increase and hold three public hearings to claim taxes on reassessed properties, even if the millage rate remains unchanged from the prior year – as is the case in the City of Statesboro.

The City has tentatively adopted the Fiscal Year 2023 budget which will require a millage rate equal to last year’s millage rate of 7.308. The millage rate is not being raised in the City, and the tax rate will be the same in 2022 as it has been for the past five years.

Due to the current housing market and inflation, the board of tax assessor’s property reassessments in the City have resulted in an increase in the value of real property in the City’s digest. Therefore, the 7.308 mills which has been the established millage rate in the city for five years, will produce an increase in taxes. The proposed tax increase for a home with a fair market value of $125,000 is approximately $21.07 and the proposed tax increase for a non-homestead property with a fair market value of $125,000 is approximately $21.95. Provided below is a breakdown of the 2022 City of Statesboro tax digest and 5 year history of levy.