BUREAU OF INTERNAL REVENUE

BUREAU OF INTERNAL REVENUE

BUREAU OF INTERNAL REVENUE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

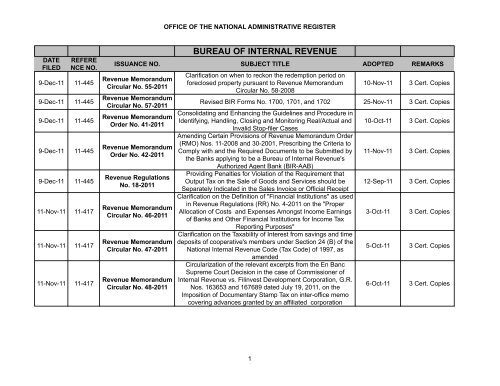

DATE<br />

FILED<br />

REFERE<br />

NCE NO.<br />

9-Dec-11 11-445<br />

9-Dec-11 11-445<br />

9-Dec-11 11-445<br />

9-Dec-11 11-445<br />

9-Dec-11 11-445<br />

11-Nov-11 11-417<br />

11-Nov-11 11-417<br />

11-Nov-11 11-417<br />

<strong>OF</strong>FICE <strong>OF</strong> THE NATIONAL ADMINISTRATIVE REGISTER<br />

<strong>BUREAU</strong> <strong>OF</strong> <strong>INTERNAL</strong> <strong>REVENUE</strong><br />

ISSUANCE NO. SUBJECT TITLE ADOPTED REMARKS<br />

Revenue Memorandum<br />

Circular No. 55-2011<br />

Revenue Memorandum<br />

Circular No. 57-2011<br />

Revenue Memorandum<br />

Order No. 41-2011<br />

Revenue Memorandum<br />

Order No. 42-2011<br />

Revenue Regulations<br />

No. 18-2011<br />

Revenue Memorandum<br />

Circular No. 46-2011<br />

Revenue Memorandum<br />

Circular No. 47-2011<br />

Revenue Memorandum<br />

Circular No. 48-2011<br />

Clarification on when to reckon the redemption period on<br />

foreclosed property pursuant to Revenue Memorandum<br />

Circular No. 58-2008<br />

1<br />

10-Nov-11 3 Cert. Copies<br />

Revised BIR Forms No. 1700, 1701, and 1702 25-Nov-11 3 Cert. Copies<br />

Consolidating and Enhancing the Guidelines and Procedure in<br />

Identifying, Handling, Closing and Monitoring Real/Actual and<br />

Invalid Stop-filer Cases<br />

Amending Certain Provisions of Revenue Memorandum Order<br />

(RMO) Nos. 11-2008 and 30-2001, Prescribing the Criteria to<br />

Comply with and the Required Documents to be Submitted by<br />

the Banks applying to be a Bureau of Internal Revenue's<br />

Authorized Agent Bank (BIR-AAB)<br />

Providing Penalties for Violation of the Requirement that<br />

Output Tax on the Sale of Goods and Services should be<br />

Separately Indicated in the Sales Invoice or Official Receipt<br />

Clarification on the Definition of "Financial Institutions" as used<br />

in Revenue Regulations (RR) No. 4-2011 on the "Proper<br />

Allocation of Costs and Expenses Amongst Income Earnings<br />

of Banks and Other Financial Institutions for Income Tax<br />

Reporting Purposes"<br />

Clarification on the Taxability of Interest from savings and time<br />

deposits of cooperative's members under Section 24 (B) of the<br />

National Internal Revenue Code (Tax Code) of 1997, as<br />

amended<br />

Circularization of the relevant excerpts from the En Banc<br />

Supreme Court Decision in the case of Commissioner of<br />

Internal Revenue vs. Filinvest Development Corporation, G.R.<br />

Nos. 163653 and 167689 dated July 19, 2011, on the<br />

Imposition of Documentary Stamp Tax on inter-office memo<br />

covering advances granted by an affiliated corporation<br />

10-Oct-11 3 Cert. Copies<br />

11-Nov-11 3 Cert. Copies<br />

12-Sep-11 3 Cert. Copies<br />

3-Oct-11 3 Cert. Copies<br />

5-Oct-11 3 Cert. Copies<br />

6-Oct-11 3 Cert. Copies

DATE<br />

FILED<br />

REFERE<br />

NCE NO.<br />

9-Dec-11 11-445<br />

11-Nov-11 11-417<br />

11-Nov-11 11-417<br />

11-Nov-11 11-417<br />

11-Nov-11 11-417<br />

11-Nov-11 11-417<br />

11-Nov-11 11-417<br />

11-Nov-11 11-417<br />

<strong>OF</strong>FICE <strong>OF</strong> THE NATIONAL ADMINISTRATIVE REGISTER<br />

ISSUANCE NO. SUBJECT TITLE ADOPTED REMARKS<br />

Revenue Memorandum<br />

Circular No. 55-2011<br />

Revenue Memorandum<br />

Circular No. 49-2011<br />

Revenue Memorandum<br />

Circular No. 51-2011<br />

Revenue Memorandum<br />

Circular No. 53-2011<br />

Revenue Memorandum<br />

Circular No. 54-2011<br />

Revenue Memorandum<br />

Order No. 37-2011<br />

Revenue Regulations<br />

No. 16-2011<br />

Revenue Regulations<br />

No. 17-2011<br />

Clarification on when to reckon the redemption period on<br />

foreclosed property pursuant to Revenue Memorandum<br />

Circular No. 58-2008<br />

Further Clarification on RMC No. 38-2011 on Expanded<br />

Withholding Tax Obligation of Philippine Health Insurance<br />

Corporation (PHIC) Including the Income Tax Withholding<br />

Obligation of Hospitals/Clinics on Case Rates of PHIC and the<br />

Matter of 5% Final Withholding VAT for Government Money<br />

Payments<br />

Circularizing Section 7 of Republic Act No. 9647 known as the<br />

"Philippine Normal Univesity Modernization Act of 2009"<br />

Effectivity and Application of Revocation of BIR Ruling Nos.<br />

002-99, DA-184-04, DA-569-04 and DA-087-06 Under<br />

Revenue Memorandum Circular (RMC) No. 27-2011 and<br />

Amending Certain Phrases Thereof<br />

Circularization of the En Banc Resolution of the Supreme Court<br />

dated August 23, 2011 denying with finality the Motion for<br />

Reconsideration on G.R. No. 193007 (Petition for Declaratory<br />

Relief on Constitutionality of Imposition of VAT on Toll Fees<br />

with the Prayer for a Protective Cover for Road users and<br />

Consumers, Renato V. Diaz and Aurora Ma. F. Timbol vs. The<br />

Secretary of Finance, et al.) [w/ attached En Banc Notice]<br />

Guidelines in the Processing of Tax Debit Memo (TDM)<br />

Applications<br />

Increasing the Amount of Threshold amounts for Sale of<br />

Residential Lot, Sale of House and Lot, Lease of Residential<br />

Unit and Sale or Lease of Goods or Properties or Performance<br />

of Services covered by Section 109 (P), (Q) and (V) of the Tax<br />

Code of 1997, as amended, thereby Amending Certain<br />

Provisions of Revenue Regulations No. 16-2005, as amended<br />

Otherwise Known as Consolidated VAT Regulations of 2005<br />

Implementing the Tax Provisions of Republic Act No. 9505,<br />

otherwise known as the "Personal Equity and Retirement<br />

Account (PERA) Act of 2008"<br />

2<br />

10-Nov-11 3 Cert. Copies<br />

3-Oct-11 3 Cert. Copies<br />

3-Nov-11 3 Cert. Copies<br />

4-Nov-11 3 Cert. Copies<br />

4-Nov-11 3 Cert. Copies<br />

28-Jun-11 3 Cert. Copies<br />

27-Oct-11 3 Cert. Copies<br />

27-Oct-11 3 Cert. Copies

DATE<br />

FILED<br />

REFERE<br />

NCE NO.<br />

9-Dec-11 11-445<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

<strong>OF</strong>FICE <strong>OF</strong> THE NATIONAL ADMINISTRATIVE REGISTER<br />

ISSUANCE NO. SUBJECT TITLE ADOPTED REMARKS<br />

Revenue Memorandum<br />

Circular No. 55-2011<br />

Revenue Memorandum<br />

Circular No. 31-2011<br />

Revenue Memorandum<br />

Circular No. 34-2011<br />

Revenue Memorandum<br />

Circular No. 35-2011<br />

Revenue Memorandum<br />

Circular No. 36-2011<br />

Revenue Memorandum<br />

Circular No. 37-2011<br />

Revenue Memorandum<br />

Circular No. 38-2011<br />

Revenue Memorandum<br />

Circular No. 39-2011<br />

Revenue Memorandum<br />

Circular No. 41-2011<br />

Revenue Memorandum<br />

Circular No. 43-2011<br />

Revenue Memorandum<br />

Order No. 35-2011<br />

Revenue Memorandum<br />

Order No. 36-2011<br />

Clarification on when to reckon the redemption period on<br />

foreclosed property pursuant to Revenue Memorandum<br />

Circular No. 58-2008<br />

Revocation of BIR Ruling [DA-(VAT-057) 552-08] dated<br />

December 18, 2008 pursuant to BIR Ruling 099-2011 dated<br />

April 6, 2011<br />

Circularization of the Relevant Excerpts from the En Banc<br />

Supreme Court Decision in GR No. 193007, on the Imposition<br />

of Value Added Tax on Toll Fees (w/ attached En Banc G.R.<br />

No. 193007)<br />

Clarification of Issues Concerning the Imposition of Improperly<br />

Accumulated Earnings Tax Pursuant to Section 29 of the Tax<br />

Code of 1997, in relation to Revenue Regulations No. 2-2001<br />

BIR Rulings on Socialized Housing under Republic Act No.<br />

7279<br />

Revocation of BIR Ruling No. DA-583-04 and Definition of the<br />

term "Special Purpose Vehicle"<br />

Clarifications on the Application of Expanded Withholding Tax<br />

on the Payments of Philippine Health Insurance Corporation to<br />

Medical Practitioners and/or Hospitals Pertaining to PHIC<br />

Members' Benefits<br />

Value Added Tax on Tollway Operators (w/ attached format of<br />

Memorandum of Undertaking)<br />

Clarifying Certain Issues Raised on the Taxability of Locally<br />

Produced Wines<br />

Circularizing Section 19 of Republic Act No. 9679 known as the<br />

"Human Development Mutual Fund Law of 2009"<br />

3<br />

10-Nov-11 3 Cert. Copies<br />

4-Aug-11 3 Cert. Copies<br />

15-Aug-11 3 Cert. Copies<br />

14-Mar-11 3 Cert. Copies<br />

26-Aug-11 3 Cert. Copies<br />

25-Aug-11 3 Cert. Copies<br />

1-Sep-11 3 Cert. Copies<br />

31-Aug-11 3 Cert. Copies<br />

8-Sep-11 3 Cert. Copies<br />

28-Sep-11 3 Cert. Copies<br />

Re-Classification of Revenue District Office 19-Sep-11 3 Cert. Copies<br />

Amendment to Revenue Memorandum Order No. 26-2011<br />

providing for Guidelines in the Tax Treatment of Separation<br />

Benefits received by officials and employees on account of<br />

their separation from employment due to death, sickness or<br />

other physical disability and the issuance of Certificate of Tax<br />

Exemption from income tax and from the withholding tax<br />

28-Sep-11 3 Cert. Copies

DATE<br />

FILED<br />

REFERE<br />

NCE NO.<br />

9-Dec-11 11-445<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

<strong>OF</strong>FICE <strong>OF</strong> THE NATIONAL ADMINISTRATIVE REGISTER<br />

ISSUANCE NO. SUBJECT TITLE ADOPTED REMARKS<br />

Revenue Memorandum<br />

Circular No. 55-2011<br />

Revenue Memorandum<br />

Order No. 02-2008<br />

Revenue Memorandum<br />

Order No. 13-2008<br />

Revenue Memorandum<br />

Order No. 20-2008<br />

Revenue Memorandum<br />

Order No. 24-2008<br />

Revenue Memorandum<br />

Order No. 27-2008<br />

Revenue Memorandum<br />

Order No. 32-2008<br />

Revenue Memorandum<br />

Order No. 14-2007<br />

Revenue Memorandum<br />

Order No. 15-2007<br />

Clarification on when to reckon the redemption period on<br />

foreclosed property pursuant to Revenue Memorandum<br />

Circular No. 58-2008<br />

Delegation of Authority to Issue and Sign "Subpoena Duces<br />

Tecum" in relation to the Conduct of Investigation on<br />

Taxpayer's Accounting Records<br />

Prescribing the Policies, Guidelines and Procedures in the<br />

Collection, Affixture, Remittance and Reporting of<br />

Documentary Stamp Tax (DST) through "Constructive<br />

Stamping or Receipt System" on Certificates Issued by<br />

Government Agencies and its Instrumentalities including Local<br />

Government Units<br />

Prescribing the Guidelines for the Preliminary Analysis and<br />

Audit/Verification of 2007 Internal Revenue Tax Returns and<br />

the Corresponding Tax Payments for Taxpayers under the<br />

Large Taxpayers Service and Revenue Regions/Revenue<br />

District Offices<br />

4<br />

10-Nov-11 3 Cert. Copies<br />

8-Jan-08 3 Cert. Copies<br />

13-Mar-08 3 Cert. Copies<br />

23-May-08 3 Cert. Copies<br />

Policies and Guidelines for RATE Cases 9-May-08 3 Cert. Copies<br />

Amendment to Revenue Memorandum Order (RMO) No. 20-<br />

2007 to Synchronize Procedures Prescribed Therein with<br />

Requirements under Revenue Regulations No. 30-2002, as<br />

amended by Revenue Regulations No. 8-2004, on the Exercise<br />

of the Compromise Power of the Bureau of Internal Revenue<br />

Amending Section III. (4) Policies and Guidelines of Revenue<br />

Memorandum Order (RMO) No. 4-2007 Relative to the<br />

Limitation on the Acceptance of Payments of Internal Revenue<br />

Taxes thru Revenue Collection Officers (RCOs)<br />

Prescribing Additional Procedures to Detect the Presence of<br />

"Fly-by-Night" Taxpayers in the Current Database of the<br />

Bureau and to Thwart their Subsequent Request to Secure<br />

Authority to Print (ATP) Sales Invoices/Official Receipts<br />

Amending RMO 10-2007 Thereby Shortening the Minimum<br />

Period of Surveillance from Thirty (30) days to Fifteen (15)<br />

days<br />

16-Jun-08 3 Cert. Copies<br />

3-Oct-08 3 Cert. Copies<br />

12-Jul-07 3 Cert. Copies<br />

18-Jul-07 3 Cert. Copies

DATE<br />

FILED<br />

REFERE<br />

NCE NO.<br />

9-Dec-11 11-445<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

30-Sep-11 11-372<br />

<strong>OF</strong>FICE <strong>OF</strong> THE NATIONAL ADMINISTRATIVE REGISTER<br />

ISSUANCE NO. SUBJECT TITLE ADOPTED REMARKS<br />

Revenue Memorandum<br />

Circular No. 55-2011<br />

Revenue Memorandum<br />

Order No. 19-2007<br />

Revenue Memorandum<br />

Order No. 20-2007<br />

Revenue Memorandum<br />

Order No. 39-2007<br />

Revenue Memorandum<br />

Order No. 40-2007<br />

Revenue Memorandum<br />

Order No. 41-2007<br />

Revenue Regulations<br />

No. 11-2011<br />

Revenue Regulations<br />

No. 12-2011<br />

Revenue Regulations<br />

No. 13-2011<br />

Revenue Regulations<br />

No. 14-2011<br />

Revenue Regulations<br />

No. 15-2011<br />

Clarification on when to reckon the redemption period on<br />

foreclosed property pursuant to Revenue Memorandum<br />

Circular No. 58-2008<br />

The Consolidated Revised Schedule of Compromise Penalties<br />

for Violations of the National Internal Revenue Code (w/<br />

attached Revised Schedule of Compromise Penalty)<br />

Simplified Processing of Application to Avail Taxpayer's<br />

Remedies under Section 204(A), Compromise Settlement, and<br />

Section 204(B), Abatement, Both of the National Internal<br />

Revenue Code of 1997<br />

Issuance of Warrants of Distraint and Garnishment, and/or<br />

Levy on Disputed Assessments Finally Decided by the Bureau<br />

Against the Taxpayer on Assessments Upheld by the Court of<br />

Tax Appeals<br />

Further Amending Pertinent Provisions of Revenue<br />

Memorandum Order (RMO) No. 57-2000, as Amended by<br />

RMO 20-2002 and RMO 35-2007, Relative to the Effect of<br />

Liftng of Closure Order<br />

5<br />

10-Nov-11 3 Cert. Copies<br />

8-Aug-07 3 Cert. Copies<br />

13-Aug-07 3 Cert. Copies<br />

12-Dec-07 3 Cert. Copies<br />

7-Dec-07 3 Cert. Copies<br />

Supplemental Provision to RMO 39-2007 19-Dec-07 3 Cert. Copies<br />

Revenue Regulations Defining Gross Receipt for Common<br />

Carrier's tax for International Carriers pursuant to Section 118<br />

of the Tax Code Amending Sec. 10 of Revenue Regulations<br />

No. 15-2002<br />

Reportorial Requirement for Establishments Leasing or Renting<br />

Out Spaces for Commercial Activities<br />

Implementing the Tax Provisions of Republic Act No. 9856<br />

Otherwise Known as "The Real Estate Investment Trust Act of<br />

2009"<br />

Amending Certain Provision of Revenue Regulations No. 5-<br />

2000 as amended, Prescribing the Regulations Governing the<br />

Manner of the Issuance of Tax Credit Certificates, and the<br />

Conditions for their Use, Revalidation and Transfer<br />

20-Jul-11 3 Cert. Copies<br />

25-Jul-11 3 Cert. Copies<br />

25-Jul-11 3 Cert. Copies<br />

29-Jul-11 3 Cert. Copies<br />

Amendment to Section 5 of Revenue Regulations No. 12-2011 26-Aug-11 3 Cert. Copies

DATE<br />

FILED<br />

REFERE<br />

NCE NO.<br />

9-Dec-11 11-445<br />

14-Jul-11 11-272<br />

14-Jul-11 11-272<br />

14-Jul-11 11-272<br />

14-Jul-11 11-272<br />

14-Jul-11 11-272<br />

14-Jul-11 11-272<br />

14-Jul-11 11-272<br />

14-Jul-11 11-272<br />

2-Jun-11 11-211<br />

2-Jun-11 11-211<br />

2-Jun-11 11-211<br />

<strong>OF</strong>FICE <strong>OF</strong> THE NATIONAL ADMINISTRATIVE REGISTER<br />

ISSUANCE NO. SUBJECT TITLE ADOPTED REMARKS<br />

Revenue Memorandum<br />

Circular No. 55-2011<br />

Revenue Regulations<br />

No. 7-2011<br />

Revenue Regulations<br />

No. 8-2011<br />

Revenue Regulations<br />

No. 9-2011<br />

Revenue Regulations<br />

No. 10-2011<br />

Revenue Memorandum<br />

Order No. 26-2011<br />

Revenue Memorandum<br />

Circular No. 24-2011<br />

Revenue Memorandum<br />

Circular No. 25-2011<br />

Revenue Memorandum<br />

Circular No. 27-2011<br />

Revenue Regulations<br />

No. 4-2011<br />

Revenue Regulations<br />

No. 5-2011<br />

Revenue Regulations<br />

No. 6-2011<br />

Clarification on when to reckon the redemption period on<br />

foreclosed property pursuant to Revenue Memorandum<br />

Circular No. 58-2008<br />

Policies in the Tax Treatment of Campaign Contributions and<br />

Expenditures<br />

Amending Certain Provisions under "Annex A" of Revenue<br />

Regulations No. 23-2003 dated August 22, 2003<br />

Amendment to Revenue Regulations No. 3-2011 providing for<br />

the Policies, Guidelines and Procedures on the Application for<br />

Change in Accounting Period under Section 46 of the National<br />

Internal Revenue Code (NIRC) of 1997, As Amended<br />

Amending Certain Provisions of Revenue Regulations (RR) No.<br />

16-2005 as Amended by RR No. 4-2007, Otherwise known as<br />

the Consolidated Value-Added Tax Regulations of 2005, as<br />

6<br />

amended<br />

Guidelines in the Tax Treatment of Separation Benefits<br />

received by officials and employees on account of their<br />

separation from employment due to death, sickness or other<br />

physical disability and the issuance of Certificate of Tax<br />

Exemption from income tax and from the withholding tax<br />

Further Clarifications on Issues/Concerns in the<br />

Implementation of the Electronic Documentary Stamp Tax<br />

(eDST) System Pursuant to Revenue Regulations No. 7-2009<br />

Circularizing Revocation of BIR Ruling DA (DT-065) 715-2009<br />

dated November 27, 2009<br />

Revocation of BIR Ruling Nos. 002-99, DA-184-04, DA-569-04<br />

and DA-087-06<br />

Proper Allocation of Costs and Expenses Amongst Income<br />

Earnings of Banks and other Financial Institutions for Income<br />

Tax Reporting Purposes<br />

Further Amendments to Revenue Regulations Nos. 2-98 and 3-<br />

98, as last Amended by Revenue Regulations No. 5-2008, with<br />

Respect to "De Minimis Benefits"<br />

Suspension of the Implementation of Revenue Regulations No.<br />

2-2011<br />

10-Nov-11 3 Cert. Copies<br />

16-Feb-11 3 Cert. Copies<br />

5-Apr-11 3 Cert. Copies<br />

28-Jun-11 3 Cert. Copies<br />

1-Jul-11 3 Cert. Copies<br />

13-Jun-11 3 Cert. Copies<br />

16-May-11 3 Cert. Copies<br />

2-Mar-11 3 Cert. Copies<br />

1-Jul-11 3 Cert. Copies<br />

15-Mar-11 3 Cert. Copies<br />

16-Mar-11 3 Cert. Copies<br />

10-Mar-11 3 Cert. Copies

DATE<br />

FILED<br />

REFERE<br />

NCE NO.<br />

9-Dec-11 11-445<br />

2-Jun-11 11-211<br />

2-Jun-11 11-211<br />

2-Jun-11 11-211<br />

2-Jun-11 11-211<br />

2-Jun-11 11-211<br />

2-Jun-11 11-211<br />

9-Mar-11 11-098<br />

9-Mar-11 11-098<br />

9-Mar-11 11-098<br />

<strong>OF</strong>FICE <strong>OF</strong> THE NATIONAL ADMINISTRATIVE REGISTER<br />

ISSUANCE NO. SUBJECT TITLE ADOPTED REMARKS<br />

Revenue Memorandum<br />

Circular No. 55-2011<br />

Revenue Memorandum<br />

Circular No. 15-2011<br />

Revenue Memorandum<br />

Circular No. 17-2011<br />

Revenue Memorandum<br />

Circular No. 18-2011<br />

Revenue Memorandum<br />

Circular No. 20-2011<br />

Revenue Memorandum<br />

Order No. 13-2011<br />

Revenue Memorandum<br />

Order No. 18-2011<br />

Revenue Regulations<br />

No. 1-2011<br />

Revenue Regulations<br />

No. 2-2011<br />

Revenue Regulations<br />

No. 3-2011<br />

Clarification on when to reckon the redemption period on<br />

foreclosed property pursuant to Revenue Memorandum<br />

Circular No. 58-2008<br />

Revocation of BIR Ruling DA 563-2006 dated September 19,<br />

2006 pursuant to CTA E.B. Case No. 287 dated January 14,<br />

7<br />

2008<br />

Proposes the Use of Basic Standards Format in Complying<br />

with the Requirements of Revenue Regulations (RR) No. 15-<br />

2010 on the Additional Notes to Financial Statements Relative<br />

to Taxpayers' Tax Compliance<br />

Income Tax Exemption of Interest Income Earnings from Long<br />

Term Deposits or Investment Certificates Under Sec 24(B)(1) &<br />

25(A)(2) of the National Internal Revenue Code (NIRC) of<br />

1997, As Amended<br />

Special Treatment of Fringe Benefits under Section 2.33 of<br />

Revenue Regulations No. 3-98, as last amended by Revenue<br />

Regulations No. 5-2011<br />

Amending Certain Provisions of Revenue Memorandum Order<br />

(RMO) No. 6-2010, relative to the Stamping of Income Tax<br />

Returns and the Attached Audited Financial Statements, and<br />

the Number of Copies of Tax Returns to be Submitted and<br />

Filed<br />

Acceptance of Out-of-District Income Tax Returns for CY 2010<br />

filed on April 14 and 15, 2011 only by Individuals Earning<br />

Purely Compensation Income<br />

Tax Treatment of Income Earnings and Money Remittances of<br />

an Overseas Contract Worker (OCW) or Overseas Filipino<br />

Workers (<strong>OF</strong>W)<br />

Filing of Income Tax Return and/or Annual Information Return<br />

by Individuals, Including Estates and Trusts<br />

Regulations Providing for the Policies, Guidelines and<br />

Procedures on the Application for change in Accounting Period<br />

Under Section 46 of the National Internal Revenue Code<br />

(NIRC) of 1997, As Amended<br />

10-Nov-11 3 Cert. Copies<br />

15-Mar-11 3 Cert. Copies<br />

17-Mar-11 3 Cert. Copies<br />

12-Apr-11 3 Cert. Copies<br />

13-May-11 3 Cert. Copies<br />

16-Mar-11 3 Cert. Copies<br />

14-Apr-11 3 Cert. Copies<br />

24-Feb-11 3 Cert. Copies<br />

1-Mar-11 3 Cert. Copies<br />

7-Mar-11 3 Cert. Copies

DATE<br />

FILED<br />

REFERE<br />

NCE NO.<br />

9-Dec-11 11-445<br />

9-Mar-11 11-098<br />

9-Mar-11 11-098<br />

9-Mar-11 11-098<br />

9-Mar-11 11-098<br />

7-Jan-11 11-016<br />

7-Jan-11 11-016<br />

7-Jan-11 11-016<br />

7-Jan-11 11-016<br />

7-Jan-11 11-016<br />

7-Jan-11 11-016<br />

<strong>OF</strong>FICE <strong>OF</strong> THE NATIONAL ADMINISTRATIVE REGISTER<br />

ISSUANCE NO. SUBJECT TITLE ADOPTED REMARKS<br />

Revenue Memorandum<br />

Circular No. 55-2011<br />

Revenue Memorandum<br />

Circular No. 5-2011<br />

Revenue Memorandum<br />

Order No. 1-2011<br />

Revenue Memorandum<br />

Order No. 3-2011<br />

Revenue Memorandum<br />

Order No. 4-2011<br />

Revenue Memorandum<br />

Circular No. 95-2010<br />

Revenue Memorandum<br />

Circular No. 97-2010<br />

Revenue Regulations<br />

No. 13-2010<br />

Revenue Regulations<br />

No. 14-2010<br />

Revenue Regulations<br />

No. 15-2010<br />

Revenue Regulations<br />

No. 16-2010<br />

Clarification on when to reckon the redemption period on<br />

foreclosed property pursuant to Revenue Memorandum<br />

Circular No. 58-2008<br />

Prescribing Documents Required to Prove Authority to transact<br />

with BIR Regarding Tax Credit Certificate (TCC) Issuance,<br />

Utilization, Revalidation and Transfer<br />

Prescribing the Policies, Guidelines and Procedures in the<br />

Implementation of Decisions/Orders on Administrative Cases<br />

Involving BIR Official/Employee<br />

8<br />

10-Nov-11 3 Cert. Copies<br />

2-Feb-11 3 Cert. Copies<br />

6-Jan-11 3 Cert. Copies<br />

CY 2011 Audit Criteria 28-Jan-11 3 Cert. Copies<br />

Amended TYs 2010 and 2011 Audit Criteria 3-Feb-11 3 Cert. Copies<br />

Increase of Excise Tax Rates on Alcohol and Tobacco Products<br />

pursuant to RA No. 9334<br />

10-Dec-10 3 Cert. Copies<br />

VAT Exemption of Services by Agricultural Contract Growers 21-Dec-10 3 Cert. Copies<br />

Late/Out-of-District Filing of Tax Returns 25-Nov-10 3 Cert. Copies<br />

Amending Pertinent Provisions of Rev. Regulations Nos. 11-<br />

2006 and 4-2010 on the Accreditation of Tax<br />

Practitioners/Agents as a Prerequisite to their practice and<br />

representation before the Bureau of Internal Revenue<br />

Amending Certain Provisions of Revenue Regulations (RR) No.<br />

21-2002, As Amended, Implementing Section 6 (H) of the Tax<br />

Code of 1997, Authorizing the Commissioner of Internal<br />

Revenue to Prescribe Additional Procedural and/or<br />

Documentary Requirements in Connection with the Preparation<br />

and Submission of Financial Statements Accompanying the<br />

Tax Returns<br />

Guidelines, Rules and Procedures in the Filing of Confidential<br />

Information & the Investigation of Cases Arising Therefrom<br />

25-Nov-10 3 Cert. Copies<br />

25-Nov-10 3 Cert. Copies<br />

25-Nov-10 3 Cert. Copies

DATE<br />

FILED<br />

REFERE<br />

NCE NO.<br />

9-Dec-11 11-445<br />

7-Jan-11 11-016<br />

<strong>OF</strong>FICE <strong>OF</strong> THE NATIONAL ADMINISTRATIVE REGISTER<br />

ISSUANCE NO. SUBJECT TITLE ADOPTED REMARKS<br />

Revenue Memorandum<br />

Circular No. 55-2011<br />

Revenue Regulations<br />

No. 17-2010<br />

Clarification on when to reckon the redemption period on<br />

foreclosed property pursuant to Revenue Memorandum<br />

Circular No. 58-2008<br />

Consolidated Regulations Implementing R.A. No. 7646, An Act<br />

Authorizing the Commissioner of Internal Revenue to Prescribe<br />

the Place for Payment of Internal Revenue Taxes by Large<br />

Taxpayers and Prescribing the Coverage and Criteria for<br />

Determining Large Taxpayers<br />

9<br />

10-Nov-11 3 Cert. Copies<br />

26-Nov-10 3 Cert. Copies