You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

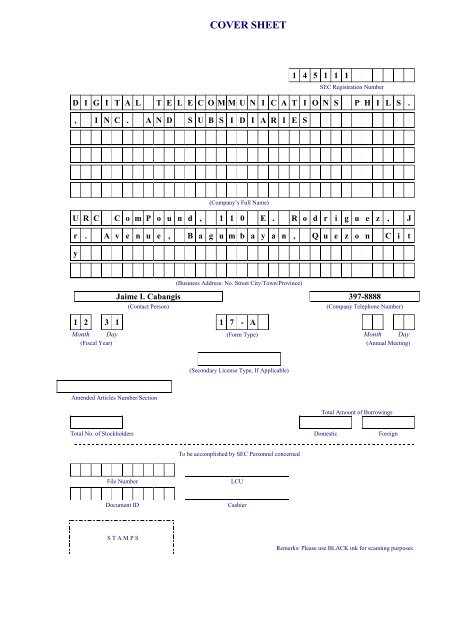

1 4 5 1 1 1<br />

SEC Registration Number<br />

D I G I T A L T E L E C O M M U N I C A T I O N S P H I L S .<br />

, I N C . A N D S U B S I D I A R I E S<br />

(Company‟s Full Name)<br />

U R C C o m P o u n d , 1 1 0 E . R o d r i g u e z , J<br />

r . A v e n u e , B a g u m b a y a n , Q u e z o n C i t<br />

y<br />

(Business Address: No. Street City/Town/Province)<br />

Jaime I. Cabangis 397-8888<br />

(Contact Person) (Company Telephone Number)<br />

1 2 3 1 1 7 - A<br />

Month Day (Form Type) Month Day<br />

(Fiscal Year) (Annual Meeting)<br />

Amended Articles Number/Section<br />

(Secondary License Type, If Applicable)<br />

Total Amount of Borrowings<br />

Total No. of Stockholders Domestic Foreign<br />

To be ac<strong>com</strong>plished by SEC Personnel concerned<br />

File Number LCU<br />

Document ID Cashier<br />

S T A M P S<br />

COVER SHEET<br />

Remarks: Please use BLACK ink for scanning purposes.

TABLE OF CONTENTS<br />

PART I - BUSINESS AND GENERAL INFORMATION<br />

Page No.<br />

Item 1 Business 4<br />

Item 2 Properties 16<br />

Item 3 Legal Proceedings 17<br />

Item 4 Submission of Matters to a Vote of Security Holders 17<br />

PART II - OPERATIONAL AND FINANCIAL INFORMATION<br />

Item 5 Market for Registrant‟s Common Equity and Related<br />

Stockholder Matters 17<br />

Item 6 Management‟s Discussion and Analysis or Plan<br />

of Operation 18<br />

Item 7 Financial Statements 24<br />

Item 8 Changes in and Disagreements With Accountants on Accounting<br />

and Financial Disclosure 24<br />

PART III - CONTROL AND COMPENSATION INFORMATION<br />

Item 9 Directors and Executive Officers of the Registrant 25<br />

Item 10 Executive Compensation 30<br />

Item 11 Security Ownership of Certain Record and Beneficial Owners<br />

and Security Ownership Management 31<br />

Item 12 Certain Relationships and Related Transactions 32<br />

PART IV - CORPORATE GOVERNANCE<br />

Item 13 Corporate Governance 32<br />

PART V - EXHIBITS AND SCHEDULES<br />

Item 14 a. Exhibits 32<br />

b. Reports on SEC Form 17-C 32<br />

SIGNATURES 33<br />

INDEX TO FINANCIAL STATEMENTS AND<br />

SUPPLEMENTARY SCHEDULES 34<br />

INDEX TO EXHIBITS 115<br />

2

SECURITIES AND EXCHANGE COMMISSION<br />

SEC FORM 17-A<br />

ANNUAL REPORT PURSUANT TO SECTION 17<br />

OF THE SECURITIES REGULATION CODE AND SECTION 141<br />

OF THE CORPORATION CODE OF THE PHILIPPINES<br />

1. For the year 2010<br />

2. SEC Identification Number 145111 3. BIR Tax Identification No. 000-449-918-000<br />

4. Exact name of registrant as specified in its charter: DIGITAL TELECOMMUNICATIONS PHILS.,<br />

INC.<br />

5. Philippines 6. _________ (SEC Use Only)<br />

Province, Country or other jurisdiction of Industry Classification Code:<br />

incorporation or organization<br />

7. 110 E. Rodriguez Jr. Ave., Bagumbayan, Quezon City 1110<br />

Address of principal office Postal Code<br />

8. (632)397-8888<br />

Issuer‟s telephone number, including area code<br />

9. Not applicable<br />

Former Name, former address, and former fiscal year, if changed since last report.<br />

10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sec. 4 and 8 of the RSA<br />

Number of Shares of Common Stock<br />

Title of Each Class Outstanding and Amount of Debt Outstanding<br />

Common stock, P1.00 par value 6,356,976,300<br />

11. Are any or all of these securities listed on the Philippine Stock Exchange.<br />

Yes [ X ] No [ ]<br />

12. Check whether the registrant:<br />

(a) has filed all reports required to be filed by Section 17 of the SRC and SRC Rule 17<br />

thereunder or Section 11 of the RSA and RSA Rule 11(a)-1 thereunder, and Sections 26 and 141 of<br />

the Corporation Code of the Philippines during the preceding twelve (12) months (or for such<br />

shorter period that the registrant was required to file such reports):<br />

Yes [ X ] No [ ] , All securities are listed as <strong>com</strong>mon stock<br />

(b) has been subject to such filing requirements for the past 90 days.<br />

Yes [ X ] No [ ]<br />

13. Aggregate market value of the voting stock held by non-affiliates as of December 31, 2010:<br />

4,743,984,627<br />

3

Item 1. Business<br />

General<br />

PART I - BUSINESS AND GENERAL INFORMATION<br />

Established in August 1987, Digital Tele<strong>com</strong>munications Phils., Inc. (“Digitel”) is 47.4% directly<br />

owned by JG Summit Holdings Inc. (“JGSHI”). Digitel has expanded its interests in wireline services in recent<br />

years and currently provides wireless/mobile tele<strong>com</strong>munication services, wireline tele<strong>com</strong>munications, hi-speed<br />

data transmission and internet services.<br />

Digitel‟s operations are divided into three key business segments: wireless tele<strong>com</strong>munication services,<br />

data transmission and internet services, and wireline tele<strong>com</strong>munication services. Digitel also provides a range of<br />

value-added services and products in each of its segments. As of December 31, 2010, Digitel has approximately<br />

14.04 million wireless subscribers (across its prepaid and postpaid options and its 2G and 3G networks) and over<br />

450,000 subscribers across its data and wireline segments.<br />

Wireless tele<strong>com</strong>munication services: In September 2001, Digitel established a wholly owned<br />

subsidiary, Digitel Mobile Phils., Inc. (DMPI), to provide wireless tele<strong>com</strong>munication services in the Philippines.<br />

DMPI is one of the Philippines‟ leading mobile tele<strong>com</strong>munications <strong>com</strong>panies. DMPI has operated its wireless<br />

mobile services under the „Sun Cellular‟ brand since 2003. Sun Cellular uses Global Service for Mobile (GSM)<br />

technology to provide voice services (local, national, international calling), messaging services (short text or<br />

multimedia messaging), outbound and inbound international roaming, broadband wireless technology, and various<br />

value-added services.<br />

Data transmission and internet services: Digitel‟s data division, the Enterprise Business Unit, offers<br />

consumer and corporate customers access to high-speed data transmission and internet services through domestic<br />

and international leased line services, frame relay, and dedicated internet lines. Digitel provides enterprise grade<br />

services and solutions to some of the top enterprise customers in the Philippines, with customer relationships in<br />

the banking, manufacturing, logistics, utilities, trading, business process outsourcing (BPO) <strong>com</strong>panies, hospitality<br />

and real estate sectors.<br />

Wireline tele<strong>com</strong>munication services: Digitel is one of the major providers of wireline <strong>com</strong>munication<br />

systems in Luzon Island. Through over 600 regional and local exchanges, Digitel telephones are now available in<br />

281 towns and cities throughout Luzon. As of December 31, 2010, Digitel had a total of almost 600,000 installed<br />

lines and over 450,000 working lines. Digitel‟s voice products and value-added services include local call,<br />

national, and international toll services, payphones and prepaid phone cards.<br />

Digitel has recently introduced the SunTel Wireless Landline to extend its landline <strong>cover</strong>age by<br />

employing GSM technology using Sun Cellular‟s network to provide an alternative last mile solution to traditional<br />

copper cable facilities.<br />

Service revenues are primarily derived from service connection fees and monthly service charges and<br />

from charges generated by voice calls that vary based on the distance, duration and time of day of the call. Since<br />

the launch of the wireless service, revenues are also generated from the sale of mobile phone kits and from charges<br />

for SMS and other value added services aside from traditional voice services.<br />

Products<br />

Wireline Communications – Voice Services<br />

To capture a significant market share in the fierce tele<strong>com</strong>munications industry <strong>com</strong>petition, Digitel<br />

offers a wide range of products and services to its customers, some of which are as follows:<br />

Fixed Landline<br />

� Digitel Choice Plans are <strong>com</strong>prehensive business and residential telephone subscription packages.<br />

These subscription plans provide unlimited local calls at very affordable fixed basic monthly fee.<br />

These Choice plans <strong>com</strong>e in metered and non-metered services with national and international calls.<br />

All Choice plans <strong>com</strong>e with Internet-ready feature.<br />

4

� Digitel Prepaid is Digitel‟s hassle-free prepaid phone card that gives subscribers convenient access to<br />

phone, fax, and dial-up internet from any Digitel postpaid and prepaid landline, SunTel wireless<br />

landline, and Digitel payphone.<br />

� Digitel Prepaid IDD is another prepaid service of Digitel that allows international call either through<br />

Digitel‟s postpaid lines, prepaid lines or payphones. With as low as P2/minute to top international<br />

destinations, callers, especially families of Overseas Filipino Workers, can now make frequent voice<br />

calls and engage in longer talk time, breaking all affordability barriers.<br />

Wireless Landline<br />

� SunTel Wireless Landline is a wireless landline service from Digitel and Sun Cellular that offers<br />

unlimited local landline-to-landline calls. Consumers can choose from the following plans: SunTel<br />

Plan 350 with free phone, Easy SunTel 350, line only and SunTel Supplementary Line 249. This<br />

service is available in the National Capital Region (NCR) including Rizal and in Bulacan, Cavite,<br />

Bataan, Pampanga, Tarlac, Benguet/Baguio, Nueva Ecija, Pangasinan, La Union, Isabela, Albay,<br />

Camarines Sur, Batangas, Laguna, Quezon, and Zambales, Ilocos, Albay, Camarines Sur, Camarines<br />

Norte, and Catanduanes.<br />

� SunTel Family Plan is Digitel‟s latest offering, for only P999 monthly service fee, subscribers can<br />

avail of 3 SunTel wireless landlines with 3 free phones, giving them savings of worth P51 per month.<br />

� SunTel GO is an innovative offering which <strong>com</strong>bines the SunTel wireless landline service with the<br />

Sun Broadband Wireless service. It provides subscribers unlimited local landline calls and unlimited<br />

internet usage of up to 1 Mbps. It <strong>com</strong>es in two variants, SunTel Go Plan 799 which is available in<br />

NCR, Rizal, Bulacan, Pampanga, Pangasinan, Tarlac, Benguet, Cavite and Laguna, and SunTel Go<br />

plan 999 which is available in NCR, Rizal, Bulacan, Pampanga, Pangasinan, Tarlac, Benguet, Cavite,<br />

Laguna, Batangas, Legazpi, Zambales and Quezon.<br />

Voice Programs:<br />

� Inbound Rewards Program is a program that entitles subscribers of SunTel Wireless Landline,<br />

Digitel Landline, and Digitel DSL (Internet and Landline bundled service) to earn rebates on their<br />

Monthly Service Fee for every in<strong>com</strong>ing inter-network long distance (NDD/IDD) and mobile call they<br />

receive. Qualified subscribers enjoy big savings on their monthly bill by simply encouraging their<br />

family and friends to call them on their Digitel Landline or SunTel wireless landline.<br />

� One Province One Local Area is a rating policy implemented in February 2010, wherein all calls<br />

made from Digitel Landline and SunTel Wireless Landlines to any landline within the same province<br />

are treated as local calls (i.e., FREE). Previous to this policy, there were certain calls to landlines of<br />

other telcos within the same province that were charged as long distance based on the interconnection<br />

agreements with the other telcos. This policy is currently being implemented in the provinces of<br />

Cavite, Bataan, Tarlac, Benguet, Nueva Ecija, Pangasinan, La Union, Isabela, Quirino, Nueva<br />

Vizcaya, Batangas, Laguna, Quezon, Zambales, Albay, Camarines Sur, Camarines Norte, and<br />

Catanduanes.<br />

Wireline Communications – Data<br />

� Digitel DSL is the high-speed, but low-cost Internet and landline bundled service catering to<br />

residential consumers all over Luzon. It <strong>com</strong>es in several packages to suit the various speed<br />

requirements of every household, ranging from 512 Kbps to as fast as 4.5 Mbps. It also offers the best<br />

value in terms of monthly fee and call rates in the market today through Plan 888 (512 Kbps), Plan<br />

999 (768 Kbps), Plan 1199 (1.0 Mbps), Plan 1799 (2.0 Mbps), Plan 2299 (3.0 Mbps), Plan 2799 (4.0<br />

Mbps) and Plan 3199 (4.5 Mbps).<br />

� Triple Unlimited is a DSL, landline and SunTel wireless landline bundled service. To avail of this<br />

great deal, DSL subscribers only have to add P249 monthly to get a free SunTel phone and make<br />

unlimited voice calls, making it the lowest-priced, full-packed bundle in the market.<br />

� Home Wi-Fi turns your home into a hot spot so all members of the family can enjoy the convenience<br />

of simultaneously logging into a high-speed Internet connection. Subscribers may avail of a two-inone<br />

Wi-Fi modem router for only P350 per month for three months or even get it for free for an<br />

extended lock-in period of 24 months.<br />

5

Wireless<br />

� DSL with free mobile phone and Sun SIM. To take full advantage of the convergence of Digitel<br />

and Sun services, new Digitel DSL subscribers can get a free mobile phone from Nokia, Samsung and<br />

My Phone with Sun prepaid kit.<br />

� 15-Day DSL Free Trial. Existing postpaid voice subscribers were given a 15-day DSL free trial to<br />

experience the higher quality of service with Digitel‟s new investments to upgrade both its local and<br />

international networks.<br />

Sun Cellular offers the latest in GSM technology, providing voice services (local, national, international<br />

calling), messaging services (short text or multimedia messaging), outbound and inbound international roaming,<br />

broadband wireless technology, and value-added services such as Mobile Internet, and up-to-date downloadable<br />

contents like ringtones, dialtunes, picture messages, and logos.<br />

Postpaid Service<br />

Sun Cellular Postpaid Plans offer customers a variety of services that respond to their <strong>com</strong>munication<br />

needs. The services offered are: Local and International Calls and SMS, Mobile Internet and Wireless Landline<br />

available under Postpaid plans with varying monthly service fees. In its <strong>com</strong>mitment to provide innovative<br />

services at affordable prices, Sun Cellular has made available the following products:<br />

� Regular Plans – These plans offer subscribers more value because they can enjoy Sun‟s unlimited<br />

calls and text services, and low call rates to other networks. Subscribers can also opt to avail of Sun‟s<br />

unlimited add-on plans.<br />

� Sun Group Plans – These plans give more value for money and designed for those who seek to build<br />

stronger ties with family and friends.<br />

� Fixed Load Plans – This is a manageable and worry-free postpaid service for individuals and<br />

<strong>com</strong>panies who want to control their mobile telephone spending and that of their immediate circle of<br />

dependents. This plan has a fixed monthly service fee, but offers the flexibility and the convenience of<br />

using prepaid services.<br />

� Sun EasyLine and Sun EasyPhone Plans – A Sun Cellular service that provides subscribers one of<br />

the easiest ways to own a postpaid line as it requires only a valid ID.<br />

� Sun Elite Series – Launched on October 2009, Sun Elite Series provide customers three unlimited<br />

services in one SIM. Sun Elite Plans are inclusive of a free high-end phone, 24/7 local Sun-to-Sun<br />

Call and Text Unlimited, Unlimited Mobile Internet and Unlimited local landline calls powered by<br />

SunTel Wireless Landline.<br />

� Sun Easy Postpaid – Sun offers another way to avail and enjoy the benefits of a Regular Plan but at<br />

the same time want the application process to be as easy as just presenting a valid ID.<br />

� Sun Double Unlimited (SDU) – Launched September 2009, this is a 2-in-1 SIM service that<br />

<strong>com</strong>bines Mobile Postpaid service with a wireless Landline service from Digitel.<br />

� BlackBerry and BlackBerry Service Add-On Plans – provide users with quality data services.<br />

Add–on Plans 700 and 999 enable subscribers to utilize the full potential of their existing BlackBerry ®<br />

handheld through Sun‟s BlackBerry ® Internet Service. BlackBerry ® Plan 2500 offers subscribers not<br />

only a free BlackBerry ® handheld but also unlimited Sun-to-Sun calls and texts, BlackBerry ® service<br />

and mobile Internet.<br />

� Sun Call & Surf – provides subscribers unlimited local Sun-to-Sun Calls & Texts plus unlimited<br />

Mobile Internet for only P999 with a free activated Android Handset.<br />

� Sun Plan 450 – is a new service targeted for customers who have a mixed mobile lifestyle of calling,<br />

texting, and Internet browsing, particularly in checking emails, social networking sites and the latest<br />

news while being on-the-go. As another option to mobile internet, subscribers can choose Sun Plan<br />

450 IDD where they get to call and text abroad for only P2 to key destinations.<br />

6

Prepaid Service<br />

Sun Cellular‟s Prepaid Service continues to attract more and more subscribers as its products are<br />

specifically designed to provide subscribers with the best-value choices tailored to fit their specific needs and<br />

wants.<br />

Sun Cellular is known for its Call and Text Unlimited (CTU) products, which allow subscribers to enjoy<br />

24 hours of Sun-to-Sun voice calls and texts for as low as P25 per day. Meanwhile, Sun‟s Text Unlimited (TU)<br />

products offer unlimited Sun-to-Sun SMS with free voice calls. For as low as P10, subscribers can have unlimited<br />

SMS and up to 5 minutes of calls to other Sun users for one day.<br />

Sun Cellular‟s regular loads, on the other hand, can be used to call or text mobile users of Sun and/or<br />

other networks. This type of load is available in call cards with denominations of P50, P150, P300, and P500, or<br />

via Xpress Load from P10-P149, P150, P300, and P500. For loading a minimum of P20 regular load, the<br />

subscriber can immediately enjoy free texts to all networks.<br />

In 2010, the Prepaid Business further widened its product line to better serve subscribers. Its products<br />

include:<br />

� Sun Call and Text Unlimited Superloaded -Sun Cellular‟s flagship Prepaid product Call & Text<br />

Unlimited is now Superloaded with extra inclusions to give the subscriber more value for money<br />

along with their favorite unlimited Sun calls and unlimited Sun texts. All denominations now <strong>com</strong>e<br />

with FREE texts to other networks and FREE minutes of Mobile Internet.<br />

� P10 Call and Text Combo (CTC10), P20 Call and Text Combo (CTC20) and P30 Call and Text<br />

Combo (CTC30) – The P10 Sun Call &Text Combo provides 40 intra-network texts, 10 minutes of<br />

intra-network calls, and 10 texts to other networks for as low as P10. The P20 Sun Call & Text<br />

Combo variant, on the other hand, offers 80 Sun-to-Sun texts, 25 minutes of Sun-to-Sun calls, and 25<br />

texts to other networks. Last in the lineup is the P30 Call and Text Combo which has 120 intranetwork<br />

texts, 40 minutes of intra-network calls, and 40 texts to other networks.<br />

� Sun TextALL – the ultimate text load that empowers subscribers to connect with everyone regardless<br />

of the network they are using was launched last July 2010. Sun TextALL provides subscribers 100<br />

Sun texts and 50 texts to other networks for only PhP15.00 a day.<br />

� Sun Unlimited Mix - the first 4-in-1 load product in the market was introduced to the mobile market<br />

last February 2010. Sun Unlimited Mix offers the perfect <strong>com</strong>bination of calls, text and mobile<br />

internet for as low as P25. Sun Unlimited Mix has two variants: P25 which has unlimited Sun texts,<br />

20 texts to other networks, 15 minutes of Sun calls every hour and 15 minutes of mobile internet, all<br />

good for 1 day, and P100 which offers unlimited Sun texts, 100 texts to other networks, 15 minutes of<br />

Sun calls every hour and 75 minutes of mobile internet, all good for 5 days.<br />

� Sun Flexi Load - Comes in two variants, the Flexi Load 50 and Flexi Load 30 offers subscribers<br />

Special “Flexi Rates” for calls and texts both to Sun and to other networks. Using this load variant,<br />

intranetwork texts could be sent for as low as P0.25 while texts to other networks will cost as low as<br />

P0.50. Sun to Sun calls meantime are pegged at P0.50 per minute, while calls to other networks cost<br />

P5.50 per minute. Subscribers also have the option of converting the flexi load to other Sun Special<br />

Loads like the Call and Text Unlimited and Call and Text Combo, among others. The promo lasted<br />

until August 23, 2010.<br />

� Sun Magic Zone Mindanao – Sun Cellular launched Sun Magic Zone Mindanao, an exclusive<br />

prepaid product for Mindanaoans which offers unlimited calls and texts with the lowest, most<br />

affordable rate at only P10.<br />

Other prepaid products include:<br />

� WinnerTXT 10 – Launched November 2009, WinnerTXT 10 is the most affordable Sun Cellular<br />

prepaid load in the market to date. For only P10, Sun Prepaid subscribers get to enjoy one day of<br />

unlimited Sun-to-Sun texting and free five minutes of consumable Sun-to-Sun calls. This means<br />

Prepaid subscribers can choose if they want to make one 5-minute call, or make several short calls.<br />

Sun WinnerTXT 10 is also available in all Xpress Load outlets nationwide. This product is valid for<br />

one (1) day.<br />

7

New Business<br />

� P5 Budgetxt and P20 Budgetxt – The P5 Budgetxt offers 10 texts to other networks while the P20<br />

Budgetxt provides 40 text messages to other networks. With Budgetxt, the cost of inter-network text<br />

messaging is lowered to just P0.50 per message.<br />

� Sun P29 Super Budget SIM - This SIM is a strong addition to the value-packed line-up of Sun<br />

Prepaid SIMs. Launched last February 2009, this SIM has Unlimited Sun-to-Sun texts and 10<br />

minutes of Sun-to-Sun calls. Being the most affordable SIM in the market to date, subscribers can<br />

easily enjoy the „Unlimited‟ advantage Sun has to offer.<br />

� Sun P49 Call and Text International SIM – Geared towards families of Overseas Filipino Workers<br />

(OFWs) here in the Philippines, this is the only Sun SIM which allows subscribers to send<br />

international texts to 20 countries for only One Peso (USA, Canada, Singapore, Hong Kong, United<br />

Arab Emirates, Malaysia, Macau, Japan, Qatar, Brunei, Guam, Hawaii, Oman, Cayman Islands,<br />

Cyprus, Turkey, Northern Marianas Islands, Jamaica, Bahamas, and Puerto Rico). Other special rates<br />

to enjoy using this SIM are US$0.10/min IDD call rate to 10 countries (USA, Canada, China, Hong<br />

Kong, Singapore, Thailand, Malaysia, Brunei, Guam, and Macau) and US$0.20/min IDD call rate to<br />

20 countries (Saudi Arabia, United Arab Emirates, India, Japan, Australia, South Korea, Taiwan,<br />

Italy, Indonesia, Hawaii, Kuwait, Bahrain, Germany, Spain, Israel, France, Greece, Jordan, Northern<br />

Marianas Islands, and Cyprus). When this SIM was launched last June 2008, the SIM has initial load<br />

inclusion of 5 minutes call to 10 countries and 5 international texts to 20 countries. Last July 2009,<br />

Sun Cellular added FREE load in this SIM – Unlimited Sun-to-Sun texts and 20 minutes of Sun-to-<br />

Sun calls, all valid for 2 days. Subscribers can now instantly get in touch with all their families and<br />

friends, here in the Philippines and abroad.<br />

� Sun Unlimited Plus Promo - Sun Prepaid subscribers get a free P25 Call & Text Unlimited (CTU25)<br />

that gives subscribers 24 hours of non-stop calling and texting to the Sun network valid for one day.<br />

Sun Prepaid subscribers just need to load P25 Call & Text Unlimited for two straight days and they<br />

will receive a FREE CTU25 automatically on the third day. Original promo dates were July 24 to<br />

September 30, 2009 but was extended until January 31, 2010.<br />

� Sun Prepaid SIMs Promo – This promo was launched simultaneously with the Sun Unlimited Plus<br />

Promo last July 2009. With the Sun Prepaid SIMs Promo, they will get more free load and enjoy the<br />

extended one-day validity of the initial load.<br />

New subscribers are treated to three days of free Unlimited Sun-to-Sun calls and texts when they buy<br />

Sun P59 Super Value SIM. If they choose Sun P39 Super Combo SIM, they get additional one-day 10<br />

minutes of Sun-to-Sun calls, 40 Sun-to-Sun texts, and 10 texts to other networks. And lastly, new<br />

Prepaid subscribers who will choose Sun P29 Super Budget SIM can enjoy additional one-day of<br />

Unlimited Sun-to-Sun texts and 10 minutes of Sun-to-Sun calls. Promo was until January 31, 2010.<br />

� Free International Texts in Sun Prepaid SIMs – Last October 7, 2009, the Sun P59 Super Value<br />

SIM, Sun P39 Super Combo SIM, and Sun P29 Super Budget SIM had additional FREE load of 5<br />

International texts to 20 countries. This is in addition to the current Prepaid SIM inclusions. Since the<br />

Sun P49 Call & Text International SIM already has free international load, now, all Sun Prepaid SIMs<br />

have free local and international load. This is a permanent offer.<br />

In 2010, Sun Cellular further strengthened its Sun Broadband Wireless (SBW) service, with more and<br />

more internet users clamoring for its affordable broadband wireless service at break-neck speeds. Sun Broadband<br />

Wireless service utilizes the most advanced 3.5G HSPA (High-Speed Packet Access) technology on an all-IP<br />

network. To address the various needs of the market, Sun Broadband Wireless has a wide range of plans and<br />

offerings to choose from:<br />

Sun Broadband Wireless Postpaid<br />

� SBW Plan 649 – the lowest unlimited broadband plan in the market with speeds of up to 2Mbps. Plan<br />

649 is offered exclusively for existing Sun Cellular Postpaid subscribers, thus allowing them to enjoy<br />

CTU 24/7 and unlimited broadband for as low as P999 per month (Postpaid Plan 350 + Plan P649).<br />

8

� SBW Plan 799 – for those subscribers who do not have a Sun Cellular Postpaid Plan, they can avail<br />

of Plan 799. Under Regular Plan 799, customers get a free modem with a lock-in period of 24 months.<br />

And for those who do not want a lengthy lock-in period, they can avail of EasyBroadband 799 by just<br />

presenting a valid ID and paying upfront for the modem.<br />

� SBW Plan 1399 - For those who want more bandwidth, Plan 1,399 is also available, with speeds of<br />

up to 3Mbps.<br />

� 3G-ready WiFi Routers – In addition to attractive plans, Sun Broadband Wireless now has offerings<br />

that will allow users to share their broadband connection via a 3G-ready WiFi router. This practically<br />

allows subscribers to set-up their own hotspot anytime, anywhere.<br />

� SBW Handset Promo - With the SBW Handset Promo, SBW subscribers can get a free phone (with<br />

1 month subscription) when they subscribe to a Sun Broadband 649 or 749 Plan.<br />

� SBW Prepaid Kit P1495 – Allows greater flexibility for those on a budget. This <strong>com</strong>es with a Sun<br />

Broadband USB stick modem plus 125 hours of free Internet usage. With its plug and play<br />

convenience, subscribers can surf the world wide web in just a few minutes.<br />

� SBW Plan 350 Lite – It is Sun‟s most flexible mobile broadband postpaid plan as it offers 45 hours<br />

of internet service and allows subscribers to reload credits through SBW Prepaid load or Sun Regular<br />

load.<br />

SBW Prepaid loads<br />

� Regular Loads – For P10 with internet usage valid for two hours.<br />

� SBW 50 – It‟s the first One-Day Unlimited load to hit the market that can be used by Sun Broadband<br />

Prepaid Subscribers as well as Sun Regular Prepaid Subscribers.<br />

� SBW 100 – For P100, this prepaid internet load <strong>com</strong>es with 12 hours Internet usage valid for four (4)<br />

days.<br />

� SBW 250 –. For only P250, subscribers get to enjoy seven (7) days of unlimited Internet usage.<br />

This may also be used on Regular Prepaid for Mobile Internet.<br />

� SBW 300 – For P300, this prepaid internet load <strong>com</strong>es with 48 hours Internet usage valid for 10 days.<br />

� Internet 25 (i25) – For just P25, prepaid subscribers can enjoy three (3) hours Internet usage valid for<br />

one (1) day. By just texting i25 to 272, subscribers can convert their Regular Load to i25, giving them<br />

the flexibility they want.<br />

� Internet 50 (i50) – One-day Unlimited internet access at an affordable price of only P50. Internet<br />

loads are now available for all SBW prepaid and regular prepaid subscribers.<br />

Value-Added Services<br />

Sun Cellular continues to keep its subscribers up to date with the latest value-added service offerings that<br />

will not hurt their pockets. Value-Added Services include:<br />

� Facebook Zero – FB Zero is another first from Sun where subscribers get Unlimited access to their<br />

Facebook Accounts with zero data charges. It is a free text-only mobile version of Facebook. Standard<br />

browsing rates of P10 per 30 minutes will apply when viewing photos or external links.<br />

� Facebook Text Alerts –With Facebook Zero, Sun subscribers can now receive free Facebook Text<br />

Alerts on their Sun phones. They can also send status updates via text for only P 0.50.<br />

� Yahoo Messenger – Sun Cellular has made available Yahoo Messenger to its subscribers. Now Sun<br />

subscribers can stay online and continue chatting with their YM buddies via text.<br />

9

� Sun Mobile Internet – Sun subscribers can access various internet services like email, search, chat,<br />

and social networking sites like Friendster, through their mobile phones. There‟s no need for a PC or a<br />

laptop. Sun Mobile Internet offers quality broadband speeds with its 3G/HSDPA network, at an<br />

affordable price of P10/30 minutes (valid for 2 hours). Recently, Sun launched new cost efficient<br />

rates of P50/ unlimited 1 day and P25/ 3 hours (valid for 1 day use).<br />

� Sun Dial Tunes – Sun Cellular‟s ring back tone service. This service allows subscribers to<br />

personalize their ring back tone with songs and sounds of their choice. Sun subscribers can choose<br />

from Sun Cellular‟s vast collection of music tracks, <strong>com</strong>ic spoofs, sound effects and even celebrity<br />

recordings.<br />

� Unlitones – Launched October 2009, Sun Cellular prepaid subscribers can now enjoy unlimited<br />

ringtone downloads for 24 hours. Subscribers simply need to go to the nearest Sun Xpressload<br />

retailer and pay P5 to avail the service. They will then receive an SMS list of ringtones<br />

(mono/polytone) that they could download from Unlitones within 24 hours from time of purchase.<br />

This service is offered in all Sun Xpress load retailers nationwide.<br />

� Give-a-Load – With its enhanced features, subscribers can give all of the Sun load variants to other<br />

Sun subscribers. This means that regular load, unlimited, and <strong>com</strong>bo call and text product can all be<br />

sent to fellow Sun subscribers.<br />

� Sun iMessenger – Sun Cellular‟s mobile instant messaging (IM) service allows Sun Cellular<br />

subscribers to chat with their IM buddies on the largest IM services. Service is available on pay-peruse<br />

and unlimited subscription.<br />

� TxtBlitz – This is an easy-to-use and cost-effective way for businesses to send messages to multiple<br />

recipients via a simple internet-protocol connection.<br />

� Zlango – Launched November 2009, Sun Cellular brings texting to a different level through fun icons<br />

which add new life to Sun subscribers‟ messages.<br />

� Gimme Load – Launched July 2009, Sun subscribers can now ask for load from their families and<br />

friends in the Sun network for free. Sun prepaid subscribers can request for load up to three (3) times<br />

per day.<br />

� SMS2EMAIL – Service that allows subscribers to send and receive email by just using their Sun<br />

phone (no internet needed).<br />

� Sun Alertz – A service that allows Sun subscribers to post tweets and status updates on their favorite<br />

social networking sites for as low as P1/txt (no internet connection needed).<br />

International Services<br />

IDD Services<br />

� Sun Todo IDD Tawag card - Allows Sun Cellular prepaid subscribers to call 7 destinations: U.S.<br />

(Main), Canada, Hong Kong, Singapore, China, Guam and Hawaii for just P2 per minute. This card<br />

also offers as low as P5 per minute to call other countries like Australia, Taiwan, South Korea,<br />

Malaysia and Macau. Sun Todo IDD Tawag card is available in P300, P100 and P50 card<br />

denominations via Xpress Load.<br />

� Sun IDD 10 - Offers an affordable IDD rate of only US $0.10 per minute for every call made to U.S.<br />

(main), China, Hong Kong, Canada, Singapore, Thailand, Malaysia, Brunei, Guam, and Macau. There<br />

are no registration, no access codes and no special card needed. Sun IDD 10 is available to all Sun<br />

postpaid and prepaid subscribers.<br />

10

� Sun IDD 30 - All Sun Cellular subscribers can enjoy savings with Sun‟s Regular IDD rate of only<br />

US $0.30 per minute to Japan, Saudi Arabia, United Arab Emirates, Australia, United Kingdom, Italy,<br />

Germany, Spain and over 100 countries.<br />

International SMS/MMS<br />

� Sun International SMS (iSMS) - All Sun Cellular subscribers can send international text messages<br />

to over 200 countries abroad. Sun Cellular‟s regular iSMS rate is only P9 per international text.<br />

� iSMS Promo – Only P2 to send an international SMS to 10 countries using any Sun prepaid SIM and<br />

also P5 to other 40 countries. Promo is extended until April 20, 2011.<br />

� Sun International MMS (iMMS) - Sun subscribers can send pictures, music, videos and other<br />

multimedia messages to their loved ones abroad in over 200 countries. Sun IMMS rates are P5 per<br />

message (for content up to 100kB) and P10 per message (for content up to 300kB).<br />

International Roaming Services<br />

� Postpaid Roaming - Postpaid Sun subscribers can roam in more than 100 countries with over 300<br />

roaming partners worldwide.<br />

� Prepaid Roaming - Prepaid subscribers can roam initially in Hong Kong, China, Singapore, Malaysia<br />

and Macau.<br />

� Data Roaming – GPRS roaming is available in over 70 countries.<br />

� Budget Roaming Text – All Sun subscribers can send text messages to the Philippines while roaming<br />

abroad for only P5/message via USSD.<br />

Other International Services<br />

� Sun Annyeong Korea SIM- Subscribers can enjoy P3 per minute IDD call and P3 per international<br />

text to South Korea. The SIM also has free IDD calls & texts to Korea, mobile internet and local Sunto-Suncalls<br />

& texts.<br />

� Sun Call Back Service – Prepaid subscribers can send a free text message to their loved ones abroad<br />

in 10 countries for a call back request on their Sun number.<br />

Sun Business (SMEs and Corporate)<br />

Sun Business is Sun Cellular and Digitel‟s Corporate and Business Solutions arm, which presents itself as<br />

the client‟s <strong>com</strong>plete tele<strong>com</strong>munications partner. It provides value-for-money wired and wireless voice, data, and<br />

specialized services so that clients could operate more efficiently. Other than the regular products mentioned<br />

above, the following are the additional products being offered:<br />

Pro-Efficiency Specialized Solutions<br />

� Track & Trace – This service allows clients to monitor the status and condition of their valuable<br />

assets and personnel through Global Positioning System (GPS) and GSM network 24 hours, 7 days a<br />

week and in real time. Clients can plan their business efficiently by using the reports that the<br />

application will generate for them.<br />

� Mobile Pay – This service provides clients a Wireless point-of-sale (POS) system for mobile selling<br />

of their goods. Clients get to receive debit and credit card payments without added cost of wired lines<br />

with a <strong>com</strong>petitively priced wireless POS. The POS uses Sun‟s superior GPRS connectivity, accepts<br />

major credit cards, and is <strong>cover</strong>ed by fire insurance. Clients are also provided with on-call<br />

maintenance and help desk facility.<br />

11

� Message Cast – This is a Web-based messaging service that allows clients to send and broadcast<br />

SMS to one or multiple recipients across all networks. Clients can make sure that their employees and<br />

customers are updated of the latest events and promos.<br />

� MobiServe – This is a customer service support center solution that allows <strong>com</strong>panies to deploy a<br />

help desk or hotline system for their customers over SMS. Clients get to improve their operations by<br />

efficiently tracking and resolving customer issues.<br />

� Sun Cash – This service is an easy-to-setup mobile payment gateway that offers 24/7 service<br />

availability with real-time payment credit. Clients can have a secure <strong>com</strong>munity based payment<br />

gateway via their Sun Mobile Phone.<br />

� Corporate Xpress Load – This is a hassle-free and efficient web-based application that allows clients<br />

to load to multiple recipients. Clients can easily manage their <strong>com</strong>panies‟ <strong>com</strong>munication expenses.<br />

This is particularly for clients with load allowance allocations for their employees and outsourced<br />

agents.<br />

Pro-Stability Premium Solutions<br />

Data Services<br />

� Domestic Leased Lines –This service delivers fast, reliable and secure dedicated point-to-point<br />

connection from the client‟s head office to the rest of the country, 24 hours a day, 7 days a week with<br />

speeds ranging from 64 Kbps up to 155 Mbps. It is an ideal tool in exchanging critical information for<br />

data, voice or video.<br />

� International Private Leased Circuit – Clients are ushered to the global business arena by providing<br />

them with global reach through dedicated point-to-point connections that span from the Philippines to<br />

United States and Asia Pacific. This is delivered through strategic partnerships with major<br />

international carriers. Sun Business owns a Point-of-Presence (POP) in Los Angeles, California and a<br />

partnership with foreign operators to offer international last mile facilities.<br />

Internet Services<br />

� Dedicated Internet Access – This service offers high-speed solutions for growing businesses that<br />

need high performance and full time dedicated internet access. This service offers a range of options<br />

to suit their access needs and support all their mission-critical <strong>com</strong>munications.<br />

� Bandwidth On Demand (BOD) – This service allows customers to utilize bandwidth over and above<br />

their subscribed plan. Higher bandwidth is made available to the customer anytime its business<br />

requires, without the hassle of application for an upgrade of service.<br />

� DSL - Sun Business DSL delivers the speed the clients‟ need for performing bandwidth-intensive<br />

network tasks, but costs only a fraction of the price of E1 and other dedicated access services. This<br />

business-grade broadband connection allows businesses to realize more productivity and cost savings<br />

right away.<br />

Managed Services<br />

� Managed Router – This service enhances end-to-end management of the clients‟ network which<br />

includes installation, configuration, monitoring and management of routers. It improves network<br />

performance and availability by extending expert monitoring and management of the clients‟ routers.<br />

12

Voice Services<br />

� Local Service, NDD/CMTS, IDD – This service allows clients to reach their customers in any<br />

destination, be it local, national, mobile and international, at very <strong>com</strong>petitive per minute rates.<br />

� Foreign Exchange Service (FEX) – This service provides similar Local Phone Service to clients.<br />

Their phone numbers are provisioned in another Digitel Serving Exchange which in effect, eliminates<br />

the national toll charges for the inbound and outbound calls. This is offered to customers with heavy<br />

volume of NDD calls.<br />

� E1R2 Service – This service provides channelized E1 networks for Voice Service terminated at the<br />

clients‟ Central Office or Private Branch Exchange. It provides 30 Voice Channels at 64Kbps per<br />

channel. This service is ideal for large businesses.<br />

IP-Based Services<br />

Competition<br />

� Internet Protocol Virtual Private Network (IPVPN) – This is a cost-effective, secure, reliable and<br />

scalable way of building a private network for <strong>com</strong>panies based on MPLS or Multi-Protocol Label<br />

Switching Technology. IPVPN sites are fully-meshed and support any-to-any connectivity with endto-end<br />

quality of service (QoS). It is well-suited for converged voice, data and video applications.<br />

� IP Centrex – This is a voice service from Sun Business using Voice over Internet Protocol (VoIP),<br />

where all subscribed phones have built-in PABX functionality. Sun Business‟ Softswitch provides all<br />

the necessary call control and service logic functions. Sun Business IP Centrex frees the clients from<br />

the costs, responsibilities and headaches of PBX ownership. Clients can call all their officemates via<br />

shortened 4-digit numbers toll free wherever they may be.<br />

From among the existing tele<strong>com</strong>munications operator franchisees, Digitel considers Smart<br />

Communications, Inc., Globe Tele<strong>com</strong>, Inc., Philippine Long Distance Telephone Co., and Bayan<br />

Tele<strong>com</strong>munications, Inc. as its major <strong>com</strong>petitors. The principal bases of <strong>com</strong>petition in both wireline and<br />

wireless segment are price, <strong>cover</strong>age, quality of service support, and speed of network access and availability of<br />

calling features.<br />

Currently, Digitel dominates the Luzon wireline market in terms of the total number of towns and cities<br />

served and lines installed. DMPI, on the other hand, is one of the fastest growing mobile network providers in the<br />

country with over 14 million subscribers supported by its almost 7,000 cellsites situated in all major cities and<br />

municipalities nationwide.<br />

The prepaid business continued to expand rapidly in 2010. Subscriber base grew by 28% from last year<br />

as more affordable and innovative products were launched. Total top-up increased by 21% <strong>com</strong>pared to 2009,<br />

while Xpress Load top-ups leaped by 22%. The number of transacting Xpressload retailers also registered<br />

significant growth of 13% from last year.<br />

Sun Cellular continued its aggressive campaign in the Postpaid business, with over 1 million subscribers<br />

<strong>com</strong>prising of 1.07 million 2G subscribers and 0.15 million 3G subscribers.<br />

Regulation<br />

Digitel requires a number of franchises and licenses from government regulators to operate in each of its<br />

business segments. Digitel holds three franchises as follows:<br />

the wireline franchise was granted in February 1994 and expires after 25 years from the date of issue;<br />

DMPI was issued a franchise to operate a wireless network in the Philippines in December 2002. This<br />

franchise expires 25 years from the date of issue; and<br />

Digitel Crossing was granted its franchise in November 2003 to construct, install, establish, operate and<br />

maintain tele<strong>com</strong>munications systems throughout the Philippines by Congress under Republic Act No.<br />

9235. This franchise expires 25 years from the date of issue.<br />

13

Each franchise is subject to amendment, termination or repeal by the Philippine Congress. Each franchise<br />

provides that the Company may offer particular services upon obtaining the permission from the NTC, which<br />

permission is granted through the issuance of Certificate of Public Convenience and Necessity (CPCNs). Upon<br />

receipt of an application for a CPCN, the NTC normally issues a Provisional Authority (“PA”), which can be<br />

renewed annually that permits operation of the service pending issuance of the CPCN. The PAs may be revoked<br />

by the NTC if the Company fails to <strong>com</strong>ply with the conditions thereof.<br />

Digitel is a grantee of various authorizations from the NTC as follows:<br />

CPCNs to (a) install, operate, maintain and develop tele<strong>com</strong>munications facilities in Regions I to V; (b)<br />

install, operate and maintain telephone systems/networks/services in Quezon City, Valenzuela City and<br />

Malabon, Metro Manila and Tarlac; (c) install, operate and maintain an International Gateway Facility<br />

(IGF) in Binalonan, Pangasinan; (d) install, operate and maintain an IGF in Metro Manila; (e) operate and<br />

maintain a National Digital Transmission Network; (f) install, operate, and maintain a nationwide CMTS<br />

using GSM and/or CDMA technology; and (g) install, operate and maintain a cable landing station.<br />

PAs to (a) install, operate and maintain LEC services in the National Capital Region (NCR); and (b)<br />

install, operate and maintain LEC services in Visayas and Mindanao.<br />

Digitel is registered with the Board of Investments (“BOI”) and is entitled to incentives on a pioneer and<br />

non-pioneer status as a new operator of tele<strong>com</strong>munications systems on nationwide CMTS-GSM <strong>com</strong>munication<br />

and as an expanding operator of public tele<strong>com</strong>munications services and international gateway facility (IGF)-2.<br />

On October 10, 2003, the BOI registration was transferred to DMPI, subject to certain conditions. Under the<br />

terms of the BOI registration, DMPI is entitled to certain incentives, including among others, an in<strong>com</strong>e tax<br />

holiday (“ITH”) for a period of six years from January 1, 2003. Subsequently, the ITH of DMPI expired on<br />

January 1, 2009.<br />

On December 28, 2005, the NTC awarded a 3G frequency assignment to DMPI after finding it legally,<br />

financially and technically qualified to undertake 3G services. On January 3, 2006, DMPI confirmed its choice of<br />

3G bandwidth with the NTC.<br />

On December 14, 2006, DMPI was registered with the BOI and is entitled to incentives on a pioneer<br />

status as a new operator of 3G infrastructure and tele<strong>com</strong>munications system.<br />

We believe we are in <strong>com</strong>pliance with all government regulations applicable to tele<strong>com</strong>munication<br />

<strong>com</strong>panies.<br />

Customers<br />

Digitel provides local metered service as well as domestic and international long distance services to<br />

individual wireline and wireless subscribers both for outbound and inbound calls. It also provides data<br />

<strong>com</strong>munications to business subscribers and internet services to both business and residential customers.<br />

Digitel‟s inter-exchange and IGF facilities are likewise tapped by other telephone <strong>com</strong>panies and private<br />

enterprises in effect be<strong>com</strong>ing customers of Digitel. Digitel also provides internet and data services to <strong>com</strong>panies<br />

in the manufacturing, trading, banking, utilities, BPOs, call centers, hospitals, hotel and real estate sectors.<br />

Sun Cellular, on the other hand, makes its prepaid services available through its thousands of Xpressload<br />

retailers, distributors, as well as The Sun Shop outlets. Postpaid services meanwhile are being provided to<br />

individuals, families, small and medium enterprises, and local <strong>com</strong>panies.<br />

Suppliers<br />

The Company has entered into major contracts with Huawei, Ericsson and Ceragon to undertake the<br />

implementation of Digitel‟s mobile network expansion projects in the Philippines. The Company expects to<br />

expand <strong>cover</strong>age to over 8,000 cellsites by end of year 2011.<br />

14

Contracts for other major projects with the following suppliers are ongoing:<br />

1. Huawei Technologies, to carry out GSM expansion and maintenance projects to enhance network<br />

<strong>cover</strong>age and capacity in the National Capital Region and South Luzon; expansion of GSM CORE<br />

Network elements; supply of equipment and other related materials for Core Network Switching System<br />

Services, Intelligent Network & Value Added Services; supply of equipment and other related materials<br />

for National Capital Region & South Luzon Base Station System Network; 3G Network UTRAN<br />

Equipment and Training; supply of equipment and other related materials for the Network Switching<br />

System & Transmission Project.<br />

2. Ericsson, to handle GSM expansion project to enhance network <strong>cover</strong>age and capacity in North Luzon,<br />

Visayas and Mindanao areas for wider nationwide <strong>cover</strong>age; equipment and supply services for Visayas<br />

and Mindanao maintenance; supply of equipments & other related materials for North Luzon, Visayas<br />

and Mindanao BSS Network Expansion.<br />

3. Ceragon Network, to supply equipment and handle survey, installation, <strong>com</strong>missioning and maintenance<br />

of the South Luzon‟s Bicol Transmission Expansion and Redundancy Project (BTEARP), NCR 13<br />

Rings and Baguio projects for high frequency and high capacity wireless networking equipment that<br />

increase network reliability and availability in Luzon.<br />

Compliance with Environmental Laws<br />

Digitel and DMPI have not been subject to any material penalties or legal or regulatory action involving<br />

non<strong>com</strong>pliance with environmental regulations of the Philippines.<br />

Employees<br />

Digitel had 4,379 employees as of December 31, 2010 of which 66% were rank & file employees, 32%<br />

were management/supervisory staff and 2% were executives. This represents a 1.4% increase in manpower level<br />

<strong>com</strong>pared to 4,317 in 2009.<br />

Revenues<br />

Digitel‟s service revenues are primarily derived from service connection fees and local monthly service<br />

charges and from charges generated by telephone calls that vary based on the distance, duration and time of day of<br />

the call. With the launch of Digitel‟s wireless service, revenues are also generated from sale of phone kits and<br />

from charges for SMS and other Value Added Services (VAS) aside from the traditional voice services.<br />

Service revenue by business unit is presented below (in P‟000):<br />

2010<br />

2009 2008<br />

Amount % Amount % Amount %<br />

Wireless 12,892,247 79% 10,155,394 73% 7,281,942 65%<br />

Wireline - Voice 2,946,127 18% 3,261,514 24% 3,630,702 32%<br />

Wireline - Data 475,283 3% 431,131 3% 358,124 3%<br />

16,313,657 100% 13,848,039 100% 11,270,768 100%<br />

Information as to domestic and foreign revenues and their contributions to total service revenues follow<br />

(in P‟000):<br />

2010<br />

2009 2008<br />

Amount % Amount % Amount %<br />

Domestic 14,047,836 86% 11,933,244 86% 9,666,693 86%<br />

Foreign 2,265,821 14% 1,914,795 14% 1,604,075 14%<br />

16,313,657 100% 13,848,039 100% 11,270,768 100%<br />

15

Other Matters<br />

On December 17, 2000, the Company entered into an agreement with East Asia Net<strong>com</strong> Philippines, Inc.<br />

(a wholly owned <strong>com</strong>pany of Asia Net<strong>com</strong>) and Asia Net<strong>com</strong> Philippines, Inc. (formerly Philippine Crossing<br />

Land Corporation) to form a joint venture known as Digitel Crossing Inc. The Company owns 40% equity interest<br />

in the said venture and residual interest shared by East Asia Net<strong>com</strong> Philippines, Inc and Asia Net<strong>com</strong> Philippines,<br />

Inc. at 40% and 20%, respectively. In addition, Digitel owns indirectly 12% of the joint venture thru Asia Net<strong>com</strong><br />

Philippines, Inc.<br />

The Company established Digitel Capital Philippines, Ltd. (DCPL), a wholly owned subsidiary, to<br />

engage in any activity allowed under any law of the British Virgin Island. In November 2004, DCPL issued Zero<br />

Coupon Convertible Bonds due in 2014 (DCPL Bonds) with a face value of US$590.1 million and issue price of<br />

US$190.0 million. JG Summit Philippines, Ltd. fully subscribed to the DCPL Bonds.<br />

Item 2. Properties<br />

Digitel‟s major properties, located in its various areas of operation, consist of tele<strong>com</strong>munications<br />

equipment, land, buildings and improvements, vehicle and work equipment, and tele<strong>com</strong>munications projects<br />

under construction.<br />

In 2005, Digitel expanded its fiber optic backbone <strong>cover</strong>age to include strategic areas in Cavite, Rizal,<br />

Laguna, Batangas and Quezon provinces. The new infrastructure, made up of New Generation SDH Multiplexers,<br />

Core and Edge Routers (all MPLS), is envisioned to address new services such as IPVPN and IP-based mission<br />

critical services requiring QoS. It is also intended to support the high bandwidth requirements of IP DSLAM and<br />

to <strong>com</strong>plement the NGN switch and Video Conference Platform in providing VoIP and video conferencing<br />

services. IPVPN services were introduced in 2005 with the <strong>com</strong>pletion of the IP-MPLS core network <strong>cover</strong>ing<br />

Binalonan, Balagtas and Galleria Corporate Center (“GCC”) in Quezon City. This is the first step on the road to<br />

building a convergent IP-based network supporting VOIP, broadband internet and video services.<br />

As of December 31, 2010, Digitel had a total of almost 600,000 lines system-wide. Its fully digital<br />

tele<strong>com</strong>munications facilities include a Luzon-wide “backbone” (long distance) transmission system consisting of<br />

radio stations and fiber optic cables and a transit exchange with interconnections with other operators in Metro<br />

Manila. Digitel also has an International Gateway Facility (“IGF”), made up of two IGF switches, one in<br />

Binalonan, Pangasinan and another in Quezon City, which provides instant connectivity to more than 200<br />

international destinations. With Digitel‟s participation in the National Digital Transmission Network (“NDTN”)<br />

undertaken by the Tele<strong>com</strong>s Infrastructure Corp. of the Philippines (“Telicphil”), the Luzon-wide “backbone”<br />

transmission facility now extends to the Visayas and Mindanao. In addition, the Company owns submarine cable<br />

capacities in the Trans-Pacific Cable-5 (TPC-5), the Asia-Pacific Cable Network (“APCN”), and the Southeast<br />

Asia-Middle East-Western Europe (SEA-ME-WE) cable systems. It also purchased capacities from the China-<br />

United States cable systems and the Guam-Philippines cable systems.<br />

Digitel has deployed ADSL ports via DSLAMS installed in the various telephone switch central offices<br />

to provide connectivity to subscribers via copper wires within a 5 kilometer radius. Parts of this deployment are<br />

high temperature tolerant DSLAMS installed inside remote switch cabinets to serve clients remotely situated from<br />

main central office exchanges. The ADSL layers also serve as the transport in providing hosted content<br />

applications services, such as Netmedic, NetAcademy, NetInventory and NetPayroll and others.<br />

Digitel‟s wireless network expansion continues to be carried out by global partners, Huawei and<br />

Ericsson. The principal <strong>com</strong>ponents of Digitel‟s digital wireless network are:<br />

cell sites, which contain transmitters, receivers and other equipment that <strong>com</strong>municate by radio signals<br />

with the wireless handsets within the range of the cell site;<br />

digital switching centers to route the calls to the proper destinations; and<br />

transmission facilities to link the switching centers to the cell sites.<br />

The Company's properties are all in good operating condition.<br />

16

Item 3. Legal Proceedings<br />

There is no material reclassification, merger, consolidation or purchase or sale of a significant amount of<br />

assets not in the ordinary course of business.<br />

report.<br />

There is no proceeding that was terminated during the fourth quarter of the fiscal year <strong>cover</strong>ed by this<br />

Item 4. Submission of Matters to a Vote of Security Holders<br />

There were no matters submitted to a vote of security holders through the solicitation of proxies during<br />

the fourth quarter of 2010.<br />

PART II - OPERATIONAL AND FINANCIAL INFORMATION<br />

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters<br />

DIVIDENDS<br />

The Company historically has not paid cash dividends on the Shares. Any payment of cash dividends on<br />

the Shares in the future will depend upon the Company‟s earnings, cash flow, financial condition, capital<br />

investment requirements and other factors, including certain restrictions on dividends imposed by the terms of the<br />

Company‟s credit and loan agreements.<br />

STOCK PRICES<br />

The Company was officially listed in the Philippine Stock Exchange on September 1996.<br />

The number of shareholders of record as of December 31, 2010 was 5,726 with <strong>com</strong>mon shares<br />

outstanding of 6,356,976,300.<br />

Quarter end stock price ranges for 2010 and 2009 are as follows:<br />

Quarter-End Dates High Low Close<br />

December 31, 2010 1.67 1.41 1.48<br />

September 30, 2010 1.74 1.37 1.57<br />

June 30, 2010 1.78 1.28 1.50<br />

March 31, 2010 1.46 1.28 1.34<br />

December 31, 2009 1.50 1.28 1.38<br />

September 30, 2009 1.64 1.28 1.44<br />

June 30, 2009 1.46 0.99 1.34<br />

March 31, 2009 1.14 0.96 1.06<br />

17

TOP 20 STOCKHOLDERS<br />

Top 20 stockholders as of December 31, 2010:<br />

Rank Name No. of Shares % to Total<br />

1. JG Summit Holdings, Inc. 3,016,079,550 47.4%<br />

2.<br />

3.<br />

4.<br />

5.<br />

6.<br />

7.<br />

8.<br />

9.<br />

PCD Nominee Corporation (Filipino) 1,359,803,841 21.4%<br />

PCD Nominee Corporation (Non-Filipino) 1,328,829,279 20.9%<br />

Express Holdings Inc. 135,231,332 2.1%<br />

Solid Finance (Holdings), Limited 110,000,000 1.7%<br />

Makati Supermarket Corporation 56,245,330 0.9%<br />

Paul Gerard B. Del Rosario 48,797,000 0.8%<br />

ABV Inc. 33,358,590 0.5%<br />

Thorton Holdings, Inc. 26,680,810 0.4%<br />

10. United Phils. Realty Corp. 17,566,550 0.3%<br />

11. Elizabeth Yu Gokongwei 15,825,000 0.2%<br />

12. Lucio W. Yan &/or Clara Y. Yan 15,050,000 0.2%<br />

13. Aurora Villanueva and/or Edwin Villanueva 13,488,550 0.2%<br />

14. BDO Strategic Holdings, Inc. 11,625,000 0.2%<br />

15. Roger C.Ang 7,100,000 0.1%<br />

16. Gregorio B. Trinidad and/or Cynthia M. Trinidad Del R 7,000,000 0.1%<br />

17. Gregorio B. Trinidad and/or Enrico M. Trinidad 7,000,000 0.1%<br />

Gregorio B. Trinidad and/or Monique Trinidad Toda 7,000,000 0.1%<br />

Gregorio B. Trinidad and/or Salome S. Adajar 7,000,000 0.1%<br />

Chak Ching Chan 6,362,000 0.1%<br />

18. Seven (7) R. Port Services, Inc. 5,000,000 0.1%<br />

19. Edwin Villanueva 4,887,630 0.1%<br />

20. Feliza and/or KT Lim Lim 4,625,580 0.1%<br />

Total 6,244,556,042<br />

Item 6. Management’s Discussion and Analysis or Plan of Operation<br />

Results of Operations<br />

2010 Compared to 2009<br />

Digitel‟s consolidated revenues for the year ended December 31, 2010 posted an 18.0% growth year-onyear<br />

at P16,543.9 million from last year‟s P14,020.0 million.<br />

Wireless <strong>com</strong>munication services recorded a 27.1% revenue growth from P10,327.4 million in 2009 to<br />

P13,122.5 million in 2010 fueled by the growth in subscriber base and introduction of more affordable and<br />

innovative products. Subscriber base stood at 14.04 million as at December 31, 2010 higher by 29.3% from last<br />

year‟s 10.86 million. Postpaid subscribers account for 1.22 million <strong>com</strong>prising of 1.07 million 2G subscribers and<br />

0.15 million 3G subscribers, an improvement of 35.6% from 0.9 million subscribers in 2009 <strong>com</strong>prising of 0.83<br />

million 2G subscribers and 0.07 million 3G subscribers. On the other hand, prepaid subscribers totaled 12.82<br />

million as at year-end 2010 <strong>com</strong>prising of 12.71 million 2G subscribers and 0.11 million 3G subscribers up from<br />

last year‟s prepaid subscribers count totaling 9.96 million <strong>com</strong>prising of 9.93 million 2G subscribers and 0.03<br />

million 3G subscribers.<br />

18

Wireline voice <strong>com</strong>munication service revenues however, dipped by 9.7% during the year to P2,946.1<br />

million from P3,261.5 million in 2009. This was mainly due to lower international and domestic tolls and local<br />

exchange partially offset by the growth in Suntel and ADSL products which registered a 17% increase over the<br />

same period last year.<br />

Wireline data <strong>com</strong>munication service revenues amounted to P475.3 million in 2010, higher by 10.2%<br />

against last year‟s P431.1 million due to the increase in domestic data and Internet services through its IPVPN<br />

services new subscriptions.<br />

Consolidated costs and operating expenses increased to P15,312.5 from P12,993.3 million in 2009 due to<br />

higher network-related and general and administrative expenses and depreciation and amortization.<br />

Consolidated EBITDA (Earnings before interest, taxes and depreciation and amortization) increased<br />

20.7% to P5,603.4 million from P4,643.0 million in 2009.<br />

After considering depreciation and amortization, consolidated EBIT (Earnings before interests, foreign<br />

exchange gain, market valuation loss and taxes) amounted to P1,231.4 million in 2010, a 19.9% improvement<br />

from last year‟s P1,026.8 million.<br />

Digitel‟s consolidated in<strong>com</strong>e before in<strong>com</strong>e tax amounted to P1,225.2 million in 2010, 541.8% more<br />

than last year‟s figure of P190.9 million.<br />

Net in<strong>com</strong>e for the year 2010 significantly improved to P526.6million, from last year‟s P259.7 million.<br />

2009 Compared to 2008<br />

Digitel registered a consolidated revenues of P14,020.0 million for the year ended December 31, 2009, up<br />

by 23.5% or P2,668.8 million from last year‟s P11,351.2 million. The increase was largely due to the significant<br />

increase in the wireless segment by 40.3% from P7,362.3 million in 2008 to P10,327.4 million in 2009.<br />

Wireline voice <strong>com</strong>munication service revenues however, dropped by 10.2% during the year to P3,261.5<br />

million in 2009 from P3,630.7 million in 2008. This was mainly due to lower international and domestic tolls and<br />

local exchange. The decline was partially offset by the growth of ADSL products which registered a 23% increase<br />

over the same period last year.<br />

Wireline data <strong>com</strong>munication service revenues amounted to P431.1 million in 2009, higher by 20.4%<br />

against last year‟s P358.1 million brought about by the growth in domestic data and Internet services through its IP<br />

VPN services new subscriptions.<br />

Consolidated costs and operating expenses rose by P2,406.5 million or 22.7% due significantly to higher<br />

network-related and general and administrative expenses and depreciation and amortization.<br />

With the significant growth in the wireless segment, the Company realized an earnings before interests,<br />

foreign exchange gain, market valuation loss and taxes of P1,026.8 million in 2009, a 34.3% improvement over<br />

last year‟s in<strong>com</strong>e before interests, foreign exchange loss, market valuation loss and taxes of P764.4 million.<br />

After considering finance costs, foreign exchange gain, market valuation loss and other in<strong>com</strong>e, Digitel<br />

posted a consolidated in<strong>com</strong>e before in<strong>com</strong>e tax of P190.9 million in 2009, a turn around from a consolidated loss<br />

before in<strong>com</strong>e tax of P3,041.9 million in 2008.<br />

Net in<strong>com</strong>e for the year 2009 is at P259.7 million versus a net loss of P1,978.1 million in 2008. This is<br />

primarily due to the increase in revenue and the positive impact of foreign exchange in 2009.<br />

Digitel continues to project an uptrend in its results of operation moving forward as the Company<br />

aggressively grow its <strong>cover</strong>age and capacity in the wireless network and integrating its wireline and wireless<br />

services to continuously bring in new, innovative and trendsetting products.<br />

19

DIGITAL TELECOMMUNICATIONS PHILS., INC. AND SUBSIDIARIES<br />

Financial Highlights and Key Performance Indicators<br />

(in PhP 000s, except for exchange rates<br />

and earnings (loss) per <strong>com</strong>mon share)<br />

Consolidated Statements of Financial Position<br />

December 31, 2010 December 31, 2009 Increase (Decrease)<br />

(Audited) (Audited) Amount %<br />

Total assets 90,897,908 82,296,941 8,600,967 10<br />

Property and equipment - net 81,326,911 72,985,125 8,341,786 11<br />

Cash and cash equivalents 1,107,231 1,112,695 (5,464) (0)<br />

Total Equity 44,515 1,349,046 (1,304,531) (97)<br />

Interest-bearing financial liabilities 33,160,605 28,860,827 4,299,778 15<br />

Bonds Payable and long-term debt 33,160,605 28,860,827 4,299,778 15<br />

Debt to equity ratio 745x 21x -<br />

Consolidated Statements of Comprehensive In<strong>com</strong>e<br />

744.93<br />

21.39<br />

Twelve Months Ended December 31,<br />

2010 2009 Amount %<br />

(Audited)<br />

Revenues 16,543,917 14,020,021 2,523,896 18<br />

Cost and Operating Expenses 15,312,501 12,993,261 2,319,240 18<br />

In<strong>com</strong>e before in<strong>com</strong>e tax 1,225,221 190,887 1,034,334 542<br />

Net In<strong>com</strong>e 526,632 259,716 266,916 103<br />

Net In<strong>com</strong>e margin 3% 2%<br />

Earnings per <strong>com</strong>mon share - basic 0.08 0.04 0.04 100<br />

Consolidated Statements of Cashflows<br />

Net cash provided by operating activities 6,969,658 6,357,021 612,637 10<br />

Net cash used in investing activities 9,503,772 11,659,396 (2,155,624) (18)<br />

Capital Expenditures 7,949,368 10,104,325 (2,154,957) (21)<br />

Net cash provided by financing activities 2,655,282 5,467,321 (2,812,039) (51)<br />

Exchange Rates<br />

Php per US$<br />

December 31, 2010 43.84<br />

December 31, 2009 46.20<br />

Financial Position<br />

2010 Compared to 2009<br />

Increase (Decrease)<br />

Consolidated assets totaled P90,897.9 million at the end of 2010, an increase of 10.5% from P82,296.9<br />

million at the end of 2009.<br />

Inventories increased by P47.0 million or 17.8% due mainly to higher handsets, phonekits, SIM cards and<br />

callcards purchased over units sold during the year.<br />

Derivative assets amounted to P571.7 million, an increase of P208.4 million or 57.3% due to mark-to-<br />

market valuation gain recognized on currency forwards derivatives.<br />

Property and equipment, net of accumulated depreciation, increased to P81,326.9 million as of December<br />

31, 2010, an increase of 11.4% from P72,985.1 million as of December 31, 2009. Additions to property and<br />

equipment amounted to P12,731.0 million and P11,737.5 million in 2010 and 2009, respectively, as a result of<br />

Digitel‟s continuing investments in tele<strong>com</strong>munications facilities, particularly in the wireless business segment.<br />

These investments were funded through bank financing, advances from affiliates and cash generated internally.<br />

Long–term debts (current and non–current) aggregating to P15,261.9 million consisted of loans from<br />

foreign banks as of December 31, 2010.<br />

-<br />

20

Bonds payable increased to P17,898.7 million in 2010 from P15,503.2 million in 2009 resulting from<br />

amortization of bond discount and additional adjustment to bring the bond carrying value to its redemption value<br />

as at December 31, 2010 in anticipation of the redemption of bonds in 2011. The adjustment is shown as equity<br />

reserve in the statement of financial position and statement of changes in equity. As at December 31, 2010, the<br />

Digitel bonds and DCPL bonds are convertible into 978,107,008 and 16,769,354,795 <strong>com</strong>mon shares,<br />

respectively.<br />

The increase in net deferred tax liabilities of P675.4 million or 24.9% arose from unrealized foreign<br />

exchange gain, capitalized interest, unamortized debt issuance cost and mark to market gain.<br />

Other noncurrent liabilities increased by P4,266.1 million or 63.8% due mainly to higher accrued network<br />

projects.<br />

Capital stock stood at P8,975.7 million as of December 31, 2010 and 2009. DIGITEL‟s deficit as of<br />

December 31, 2010 amounted to P7,100.1 million <strong>com</strong>pared from P7,626.7 million as of December 31, 2009.<br />

Digitel‟s financing requirements were <strong>cover</strong>ed by both internally generated funds and external<br />

borrowings. Consolidated net cash flow provided by operating activities in 2010 amounted to P6,969.7 million as<br />

<strong>com</strong>pared to P6,357.0 million in 2009. Net cash financing from external sources amounted to P2,655.3 million in<br />

2010 and P5,467.3 million in 2009.<br />

2009 Compared to 2008<br />

Consolidated assets totaled P82,296.9 million at the end of 2009, an increase of 9.4% from P75,233.8<br />

million at the end of 2008.<br />

Inventories increased by P37.7 million or 16.7% due mainly to higher handsets, phonekits and<br />

accessories purchased over units sold during the year and purchase of laptops for the broadband wireless service.<br />

Derivative assets <strong>com</strong>prise mainly of embedded derivatives in foreign currency denominated purchase<br />

orders and contracts significantly for network-related projects, amounted to P363.4 million as of December 31,<br />

2009, a decrease of P271.8 million or 42.8% from previous year‟s figure of P635.2 million.<br />

Prepayments and other current assets rose by P68.5 million or 25.9%. This is attributable mainly to<br />

higher prepaid taxes and prepaid rent brought about by the additional cellsites roll-out during the year.<br />

Property and equipment, net of accumulated depreciation, increased to P72,985.1 million as of December<br />

31, 2009, an increase of 12.5% from P64,885.5 million as of December 31, 2008. Additions to property and<br />

equipment amounted to P11,737.5 million and P12,528.8 million in 2009 and 2008, respectively, as a result of<br />

Digitel‟s continuing investments in tele<strong>com</strong>munications facilities, particularly in the wireless business segment.<br />

These investments were funded through bank financing, advances from affiliates and cash generated internally.<br />

Accounts payable and accrued expenses decreased by P1,216.8 million or 15.0% due to settlement of<br />

various liabilities during the year.<br />

Long–term debts (current and non–current) aggregating to P13,357.6 million consisted of loans from<br />

foreign banks as of December 31, 2009.<br />

Digitel obtained financing from foreign and local affiliates to fund the wireless <strong>com</strong>munication services<br />

network. As of December 31, 2009 and 2008, outstanding balances were P33,369.3 million and P30,048.2<br />

million, respectively.<br />

Bonds payable increased by P874.7 million during the year due mainly to the amortization of bond<br />

discount.<br />

Capital stock stood at P8,975.7 million as of December 31, 2009 and 2008. Digitel‟s deficit as of<br />

December 31, 2009 amounted to P7,626.7 million <strong>com</strong>pared to P7,886.4 million as of December 31, 2008.<br />

Digitel‟s financing requirements were <strong>cover</strong>ed by both internally generated funds and external<br />

borrowings. Consolidated net cash flow provided by operating activities in 2009 amounted to P6,357.0 million as<br />

21

<strong>com</strong>pared to P2,470.8 million in 2008. Net cash financing from external sources amounted to P5,467.3 million in<br />

2009 and P8,989.9 million in 2008.<br />

Prospects for the Future<br />

It was another remarkable year for Digitel, defying negative growth forecasts for the industry, by posting<br />

positive double digit-growth in Net Service Revenues. Without doubt, a major driver for the growth is the<br />

<strong>com</strong>pany‟s wireless arm, Sun Cellular, which holds the unenviable position of being the first to achieve<br />

acquisition of over One (1) Million in postpaid subscriptions in the country, remaining the preferred postpaid<br />

brand for the third straight year, with 7 out of 10 new postpaid subscribers availing themselves of Sun Cellular<br />

products and services.<br />

In 2010, Sun Cellular remained the only mobile tele<strong>com</strong>munications provider of a truly reliable unlimited<br />

service for its over 14 million subscribers. As Sun Cellular continues its stronghold over the unlimited call and text<br />

market, it is supported by a robust network built for the provisioning of unlimited texts, calls, and mobile internet<br />